Congress to study bill to add PR to U.S. bankruptcy code

A subcommittee of the House Judiciary Committee announced Thursday it will hold a hearing on House Resolution 870, known as the Puerto Rico Chapter 9 Uniformity Act of 2015, at 11:30 a.m. on Feb. 26th in Washington D.C.

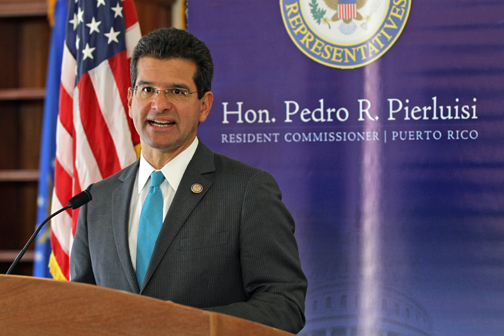

H.R. 870, which was introduced by Resident Commissioner Pedro Pierluisi on Feb. 11th, would empower the Puerto Rico government to authorize one or more of its government-owned corporations, if they were to become insolvent, to restructure their debts under Chapter 9 of the federal Bankruptcy Code, as all state governments are already empowered to do under current law.

The Judiciary Committee’s Subcommittee on Regulatory Reform, Commercial and Antitrust Law, which has jurisdiction over bankruptcy law, will hold the hearing. The chairman of the full Judiciary Committee is Congressman Bob Goodlatte (R-VA) and the ranking member is Congressman John Conyers, Jr. (D-MI).

The chairman of the Subcommittee is Congressman Tom Marino (R-PA) and the ranking member is Congressman Hank Johnson (D-GA). The subcommittee consists of eight Republicans and five Democrats.

The subcommittee is expected to invite four witnesses to testify about the bill, and to answer any questions posed by members of the subcommittee. The list will be announced ahead of the hearing. In addition, individuals and organizations will be able to submit statements, in letter form, that could potentially be made part of the official hearing record.

“I want to thank Chairman Goodlatte, Ranking Member Conyers, Chairman Marino and Ranking Member Johnson for scheduling a hearing on this critically-important and time-sensitive bill,” Pierluisi said. “It is my hope and expectation that the hearing next Thursday will be productive.

“Many stakeholders support this bill, and this hearing will provide them with the opportunity to memorialize and explain their support. Although no objections to the bill have been registered with me up until now, if there are any concerns about the legislation, those concerns can be raised and addressed at the hearing,” he said.

The point of the hearing is to create a comprehensive record that will help the Committee’s leadership determine whether to take the next step in the legislative process, which would be to hold a vote on the bill, said Pierluisi.

If enacted, the legislation would enable the Puerto Rico government to authorize its public corporations to seek relief under Chapter 9 as a last resort in the event of insolvency, under the supervision of an impartial federal bankruptcy judge, based on substantive and procedural legal precedent established in Chapter 9 proceedings that have taken place throughout the United States.

“My bill does not entail a transfer of any funds from the U.S. government to the government of Puerto Rico; it merely empowers the Puerto Rico government to authorize its insolvent public corporations to utilize a tried-and-true legal procedure,” Pierluisi said.

“I believe this is in the best interests of all stakeholders, including creditors, who are craving stability in a time of deep uncertainty. It is also in the clear interest of my constituents, who need a government that is on sound financial footing and that can provide essential services,” the Resident Commissioner added.

Individuals or organizations wishing to submit a letter that Pierluisi can seek to be made part of the hearing record should send an email to [email protected], attaching the letter before the hearing.

Last year, the government of Puerto Rico passed a law establishing a local mechanism to restructure financially troubled public agencies, which was subsequently contested and shot down in court. The government has said it will appeal the decision in Boston.