García-Padilla: P.R. to make most of debt payment in Jan.

The government of Puerto Rico will make most of its $1 billion debt payment due Jan. 1, defaulting only on some $37 million of the amount, Gov. García-Padilla said Wednesday.

The government will pay some $434 million after deductions for capitalized interest and certain federal subsidies in debt issued or guaranteed by the Commonwealth, also known as General Obligation bonds.

To cover the payment, the Commonwealth will use $174 million in amounts collected via the enactment of clawback provisions that redirect revenue earmarked for one debt to cover another expense. Specifically, the governor ordered clawback of revenue allocated to the Highways and Transportation Authority (HTA), the Puerto Rico Infrastructure Financing Authority (PRIFA), and the Convention Center District Authority (CCDA), the Government Development Bank confirmed.

Meanwhile, Puerto Rico Electric Power Authority will cover some $176 million of its own power revenue bond debt, which it has restructured through separate negotiations with its creditors.

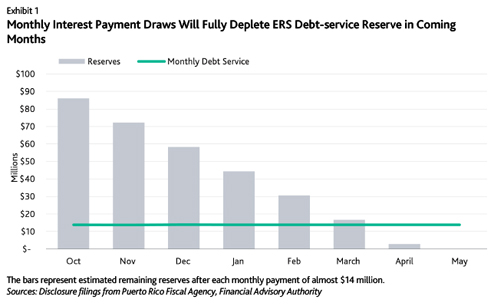

García-Padilla said the government will also pay another $383 million on debt not guaranteed by the Commonwealth with reserves accumulated by trustees prior to the application of the clawback provision. The list includes: some $10 million in outstanding GDB notes; $92 million in Public Building Authority bonds; $11.4 million in guaranteed PRIFA bonds; $15.4 million in bonds issued by the Puerto Rico Sales Tax Financing Corp.; $1.7 million in University of Puerto Rico bonds; $9.5 million in CCDA bonds; $101.7 million in HTA bonds; $13.9 million in Employee Retirement Systems bonds; and $10.1 million in Puerto Rico Industrial Development Corp. debt.

During a press conference, García-Padilla said the government does not have resources available to pay some $35.9 million in interest due on PRIFA bonds and $1.4 million due for interest for bonds issued by the Puerto Rico Public Financing Corp.

Furthermore, as a result of the authorization of the clawbacks, García-Padilla said “no further payments are being made into the trusts from which payments are drawn for the creditors of certain issuers. This means a default in those payments.”

“My decision maintains the government’s operational capacity to continue slowly repaying tax refunds as well as our past-due debts with our suppliers,” he said. “There is no reason why our citizens should be the only ones to shoulder the burden of the lobbying by hedge funds and vulture funds and the apathy of Congress.”

Puerto Rico’s fiscal team has unsuccessfully spent the better part of the past year lobbying in Congress to regain access to Chapter 9 provisions of the U.S. Bankruptcy Code to be able to restructure the bulk of its $73 billion in debt.

U.S. House Speaker Paul Ryan has vowed that Congress will put forth a “comprehensive legislative package” to solve the island’s crisis during the first quarter of 2016, after the debt is due.

“The lack of any legal framework for an orderly restructuring process, and the blocking of the local Recovery Act, which allowed for the orderly judicial process that we have asked from Congress, has forced the Commonwealth to decide which payments can be made with the few resources available,” García-Padilla said.

Puerto Rico has 18 credit-issuing entities, of which 13 have payments due in January.

“No amount of lobbying can change the math or the facts — there isn’t enough money to provide essential services to the people of Puerto Rico, repay our existing obligations and grow our economy, which is the only way the Commonwealth will ever be able repay our creditors,” GDB President Melba Acosta said.

“We expect to make a specific proposal to our creditors during the month of January and hope they will provide us the support we need to navigate through this crisis,” she said.

“Whether or not that support is forthcoming, with over 17 different issuers, thousands of different creditors, and embedded inter-creditor conflicts throughout the Puerto Rican debt complex, we know we will need Congress to provide us the tools we need to overcome this crisis as soon as they return from recess. The American citizens of Puerto Rico deserve nothing less than swift action,” Acosta said.

The administration’s decision drew quick criticism from the head of the opposing party and Resident Commissioner Pedro Pierluisi.

“Today is a disastrous day in the history of Puerto Rico. For the first time in its history, several public corporations of our government will fail to meet their financial obligations. The consequences of this irresponsibility will be rather harsh for all Puerto Ricans,” Pierluisi said.

“My message, both to the people of Puerto Rico as the financial markets is that the months of this irresponsible and improvised administration are numbered. And that Puerto Rico will again have an administration that will return the value to its word,” he said.

While the Commonwealth remains on an “obvious” default path, Pierluisi said the island needs a break, either via a restructuring mechanism or new financial resources.

“Congress has several options under its consideration, including possible access to Chapter 9 and legislation that expressly authorizes the U.S. Treasury or the Federal Reserve Bank to ensure funding of our public institutions. These measures have to be a priority issue for the Congress to avoid a catastrophe of proportions never before seen in Puerto Rico and in the financial markets. A default benefits no one,” Pierluisi said.