Gov’t reports $649.4M in July revenue collections

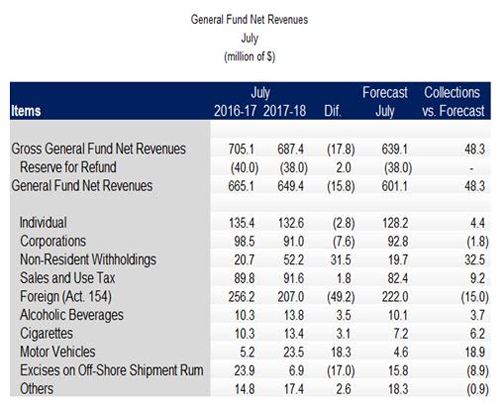

Treasury Secretary Raúl Maldonado-Gautier announced that net revenues recorded to the General Fund in July, when Fiscal Year 2017-18 began, totaled $649.4 million.

“Monthly estimates of $601.1 million were surpassed by $48.3 million, or 8 percent. On the year-over-year comparison, there was a difference of $15.8 million,” he said.

“This difference is mainly attributed to a temporary reduction of $49.2 million in the Act 154 (2010) excise tax category; part of this reduction was expected and was taken into account in the monthly projections,” he added.

The main revenue driver, responsible for July’s above-estimate collections, was the non-resident withholding category, with $32.5 million. Manufacturing companies pay this tax for the use of manufacturing patents.

Revenues from consumption taxes, such as the Sales and Use Tax (SUT), cigarettes, motor vehicles and alcoholic beverages, were also positive, Maldonado-Gautier said.

“The increase in cigarette excise tax collections was due to two reasons — an increase in this excise tax and fiscal oversight associated with interventions against illegal cigarette sales,” he said.

In July, SUT collections totaled $213.7 million, $4.2 million, or 2.0 percent, above last year. Of the total, $91.6 million of SUT revenue went to the General Fund, an increase of $1.8 million year-over-year.

Beginning in August, a new SUT collection mechanism was implemented, which allows merchants to remit payments on the 15th and the last day of each month. This initiative is expected to bring in increased SUT revenues, the government official predicted.