Treasury: FY ’17 collections exceed $9.3B, up 1.7% YOY

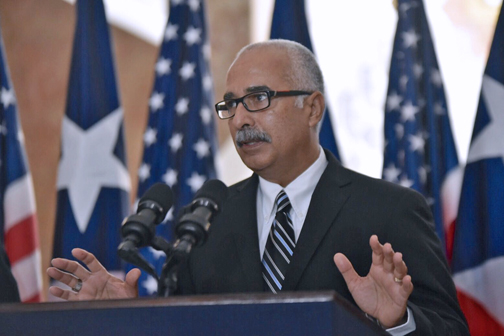

Puerto Rico’s net revenue recorded to the General Fund for Fiscal 2017 (July-June) exceeded $9.3 billion, representing a $159.6 million, or 1.7 percent, increase when compared to Fiscal Year 2015-16, Treasury Secretary Raúl Maldonado-Gautier said Thursday.

Actual revenues were above revenue estimates of $9.1 billion by $234.9 million, or 2.6 percent, he said.

He said the numbers represent a “significant fiscal accomplishment” given the ongoing challenges Puerto Rico’s public finances are facing.

In addition, Maldonado-Gautier said the current administration revised the revenue projection for the year on two occasions.

The first revision was at the time the Fiscal Plan was certified on March 13, 2017, when it was set at $9.1 billion, and then on May 29, 2017, when it was revised to $9.2 billion. Actual revenues were $9.3 billion, exceeding both revisions, he said.

The main drivers were the foreign corporations excise tax (Act 154), the Sales and Use Tax (SUT), and the motor vehicle excise tax.

Revenue from the foreign corporations excise tax (Act 154) increased to $2 billion from $1.8 billion the previous year. Revenues from this excise tax increased by $215.9 million, or 11.6 percent, year-over-year, and were $154.2 million above projections, the agency confirmed.

SUT collections in Fiscal 2017 totaled $2.5 billion, that is, $170.5 million, or 7.2 percent, above the previous year. The agency pegged the increase in SUT revenues to the fact that collections for the month of July of Fiscal 2017 were at the rate of 10.5 percent while in July of Fiscal 2016 they were at the rate of 6.0 percent, which represented some $73.7 million more in collections.

Another reason was that the B2B was in force during 12 months, while when the B2B was implemented in 2016, it was in force for eight months. The four-month difference reflected $51 million more this year, and a better capture rate considering the situation of Puerto Rico’s economy, Maldonado-Gautier said.

Another important revenue category this year was the motor vehicle excise tax, which pumped $369.2 million into the General Fund, or $83.6 million more than in the previous year, and $76.2 million above projections. An increase in automobile sales was observed despite the economic downturn, Treasury said.

Lastly, the agency pointed out that revenue estimates for Fiscal 2018, which just began, are $9.5 billion, $9.1 billion of which would correspond to General Fund net revenues.

“One of the main goals for this new fiscal year is to achieve revenue projections through different fiscal oversight and compliance initiatives that are already being implemented and other new measures that will be implemented,” Maldonado-Gautier said.