GDB, Treasury provide liquidity, cash flow updates

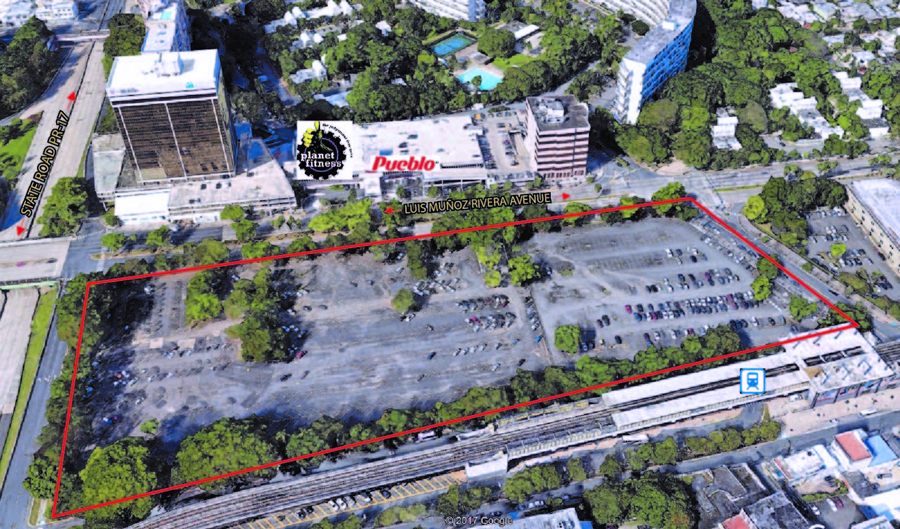

As of Oct. 17, the GDB had $1.9 billion in liquid assets, including cash, bank deposits and unencumbered marketable U.S. government securities. (Credit: © Mauricio Pascual)

As part of its initiative to enhance public disclosure, the Government Development Bank for Puerto Rico recently provided a “special liquidity update,” while the Treasury Department posted a Commonwealth General Fund cash flow projection for Fiscal 2015.

As of Oct. 17, the GDB had $1.9 billion in liquid assets, including cash, bank deposits and unencumbered marketable U.S. government securities, an amount the government agency said is “consistent with projections made in the GDB’s March Special Liquidity Update, net of contingencies.”

“As it did in March, the GDB affirms that it expects to have sufficient liquidity during fiscal year 2015 to meet all its obligations and continue supporting Puerto Rico’s fiscal stability and economic growth. In contrast to March, the central government also has no short-term financial obligations [other than the recently issued TRANs and scheduled amortization requirements on the public debt] that mature or are subject to potential termination or acceleration during this fiscal year,” the GDB said.

“GDB’s liquidity has been materially strengthened during 2014 by the successful completion of the landmark $3.5 billion Commonwealth GO transaction in March, which repaid approximately $1.9 billion in GDB lines of credit, and the issuance of $900 million aggregate principal amount of 2015 Series B Senior Notes by GDB, which was used to fund the Commonwealth’s TRANs. We will continue to take affirmative measures to strengthen GDB’s liquidity in order for it to perform its statutory mission,” said GDB Interim President Jose V. Pagan.

According to the bank, material events affecting its liquidity since the March update are:

On October 10th, the GDB entered into a Note Purchase, Revolving Credit and Term Loan Agreement with a syndicate of top-tier financial institutions that provided for the issuance of $900 million aggregate principal amount of 2015 Series B Senior Notes by GDB (“the GDB Notes”). The GDB Notes Agreement provides for a $200 million revolving line of credit and a $700 million term loan with scheduled draws.

The proceeds will be used to make a loan to the Commonwealth in the form of $900 million aggregate principal amount of Tax and Revenue Anticipation Notes of the Commonwealth of Puerto Rico, Series B. The notes mature on June 30, 2015 and are subject to amortization requirements, which commence on April 16, 2015. As of the Oct. 17, the GDB had drawn $700 million, and the remaining $200 million is scheduled to be drawn on Nov. 13, 2014.

With the issuance of the GDB Notes, the Commonwealth repaid the GDB $400 million in short-term loans, which had been granted in September 2014. The $400 million repayment increased GDB’s liquidity resources, as reflected in the GDB liquidity projection published on Oct. 17, 2014.

In May 2014, the GDB repurchased $200 million in variable rate debt obligations (“VRDOs”) issued by the Puerto Rico Highways and Transportation Authority (“PRHTA”). The GDB purchased the VRDOs because the underlying credit enhancement was not extended or replaced.

Additionally, the GDB did not receive a $247 million payment of GDB appropriation debt, which was [reprogrammed] in order to reduce the Commonwealth’s fiscal year 2014 deficit. The affected GDB appropriation debt was satisfied in part through a reallocation of approximately $200 million in proceeds from the Commonwealth’s Series 2014 Bonds. The terms of the GDB appropriation debt that was not reallocated were modified to provide for payment in future fiscal years.

Meanwhile, Treasury’s cash flow update indicates projected total revenues for Fiscal 2015 of $9.5 billion; financing uses of $1.2 billion; total expenditures of $8.2 billion; and a net cash balance reduction of $3.7 million. Treasury projects an ending cash balance for the fiscal year of $35.6 million.