Abexus: Puerto Rico’s dependency on federal funds will linger in ’21

The year 2021 will be characterized by a strong dependency of federal funds across a number of industries, as the effects of the blow the COVID-19 pandemic dealt to Puerto Rico’s economy, local firm Abexus Analytics concluded in a study.

“This next year will be characterized by a strong dependency of federal funds, not just in terms of household consumption, such as federal assistance programs like the Supplemental Nutritional Assistance Program or its local version, the Nutritional Assistance Program, but the construction industry, the real estate market, municipal government expenditures, infrastructure, education, and the health industry, will all continue to be subsidized by the U.S. government,” said Economist Adrián Alós, CEO of the firm.

Last week, Abexus Analytics unveiled its latest set of projections for the local economy, as well as highlighted the main trends that are affecting the grocery industry in Puerto Rico in an event sponsored by the Chamber of Marketing, Industry and Food Distribution (MIDA, in Spanish).

“The accelerated transition to a digital work environment, along with new investments in technology, will have different effects, geographically, by industry and demographically,” Alós said.

For instance, the elderly population will have greater barriers to new consumption mechanisms, but also younger generations will highly welcome those long-awaited changes.

Given the lack of up-to-date data from the government, Alós provided an analysis of the labor market and how almost 210,000 workers remain under federal unemployment benefits to cope with the economic crisis caused by the pandemic.

This condition will maintain aggregate demand below pre-pandemic levels for 2021, he said.

In terms of retail establishments, Alós noted that the economy has not returned to pre-pandemic levels, but since May 2020, the total number of salaried jobs in retail have increased consistently. Yet, total employment has maintained a downward trend.

Abexus Analytics also analyzed some of the mega-trends that will be conditioning the performance of the economy in 2021.

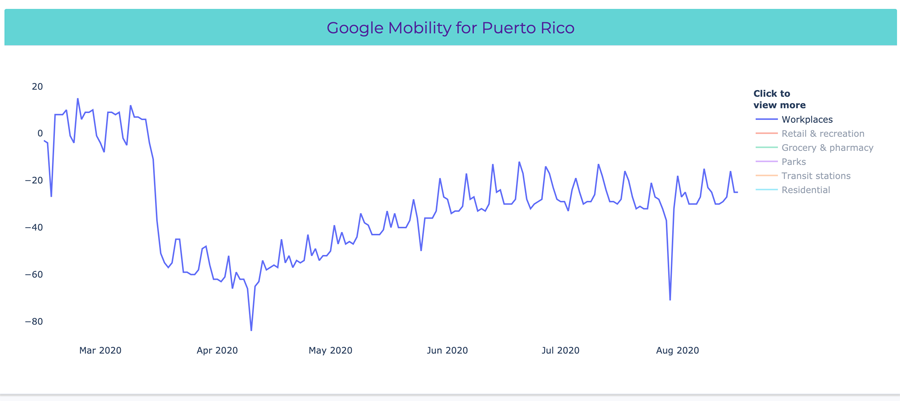

Among those are the results of the firm’s business mobility tool, which showed that any increase in mobility to work environments have been associated with a spike in the number of positive COVID-19 cases.

“These changes are also positively correlated with a decline in fiscal revenues which most probably will require the use of federal funds to stimulate the economy during 2021,” Alós said.

As expected, the increase in mobility is also associated with larger disruptions to supply-chain mechanisms. This should not be equated with a shortage of goods, but rather short-term disruptions.

Abexus noted that changes in consumer behavior such as “stockpiling” and larger receipts at grocery stores will push smaller establishments increase their offer, particularly beyond convenience products.

As part of these mega-trends, Abexus also noted that export services — mainly supported by relocation of members of the diaspora — manufacturing and distribution of hemp/cannabis will continue to show a positive growth rate for 2021.

Yet, the overall performance of the economy will be curtailed by their GNP forecast which shows the economy with a -4.8% for fiscal year 2020 and a -3.2% for fiscal 2021.

In terms of inflation, Abexus does not foresee any radical changes and inflation numbers will remain relatively low, partially due to a lackluster aggregate demand. This will hold true for Puerto Rico and U.S. as a whole, Alós said.