Aon study: Company directors and officers facing ‘unprecedented times’

Company directors and officers (D&O, for short) are facing “unprecedented times,” by not only having to manage a whirlwind of change and disruption in their business models as factors such as technology, changing buyer behaviours, socio-demographic shifts and climate change begin to exert their influence, but they’re also being confronted by the global spread of a highly litigious culture.

This, according to a report released by global professional services firm Aon, which concludes that the trend is greatly due to an increase in securities litigation and an expansion of class action type litigation.

“A combination of inadequate ratings with larger almost ‘catastrophe-like’ settlements being seen in an overall deteriorating claims environment, has meant that insurers have been feeling the pressure at both ends of the business,” according to the report.

So, Aon’s study concludes that D&O “plays an incredibly important role for companies looking to attract and retain the best management team in an environment where heightened and increased oversight is a fact of corporate life with new and emerging focus on areas around environment, reputation, sexual harassment, discrimination, and cybersecurity.”

“This study, based Aon´s data and analytics capabilities aims to shine a light on the big changes being seen in D&O by businesses around the world and to help insureds prepare and navigate the changing market and challenges that it represents,” said Denise Colón, Aon’s financial lines manager.

The study confirms that structural shift in the market is taking place. Up to now, financial lines and especially D&O have offered insurers an uncorrelated alternative to their more traditional property and casualty portfolio.

This appeal has led to a pool of lead insurers staying relatively consistent with the primary markets dominated by the traditional, large financial lines players competing to take business off each other either through price, available capacity, widening terms and conditions, or all three. In excess layers, Aon saw new carriers come in and as a result pricing decrease significantly, resulting in many insureds using the savings to buy additional limit/coverage.

However, the good times for buyers are over and every D&O buyer should expect — with their broker — to work harder to get cover while minimizing rate increases as best they can and holding on to acceptable limits, the study showed.

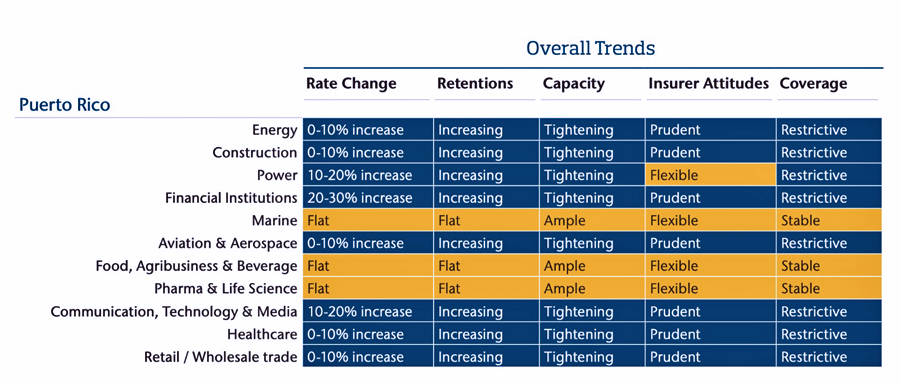

Latin America’s D&O experience is one of widespread price increases across most industry sectors and in almost all countries. Class action lawsuits are seeing an uptick in Puerto Rico, where the Bar Association is looking for opportunities where people have been negatively affected financially, the study confirmed.