Economist firm: Puerto Rico still ‘moving sideways’

Puerto Rico needs to find its “true north,” by aligning all of its efforts and resources toward achieving economic growth and job creation, or risk experiencing an outcome “much worse than has so far been imagined,” said economist firm H. Calero Consulting Group in its most recent edition of “Compass,” an internal publication.

During the first quarter of the year, Puerto Rico has continued to “move sideways” with a number of expansionary and recessionary policies that have caused a zero net effect, the firm said. While it was able to go to market and raise $3.5 billion in general obligation bonds, it did so at a high interest rate.

The government also worked hard on several initiatives to restore growth and create jobs — the “All-Star Island” promotional campaign, the Jobs Now Act and a proposed energy reform — that have fallen short “due to a lack of coordination and difficulties to deliver a clear message,” the economist firm noted.

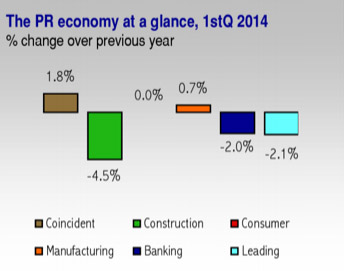

Meanwhile, the island’s key economic indicators for the quarter have also supported the persistently weakened economy, ranging from near zero positive to solid negative.

“The Coincident grew 1.8 percent as few new investments and increased taxes have made further improvements extremely difficult. Construction fell 4.5 percent but, without the two-digit loss of the past quarters. The Consumption Index posted 0 percent growth with shrinking demand, driven by high oil and utility prices as well as reduction in population and income,” the firm said in its publication.

In this quarter, the Coincident index recorded an increase of 1.8 percent, with a slight 0.9 percent job growth, but with a jump of 7.2 percent in extended working hours and payroll. Construction jobs halted as cement sales dropped to -9.3 percent.

Another indicator, the banking index, posted –2.0 percent, following Moody’s ratings revisions of the island’s three principal banks — Banco Popular, Santander and FirstBank. Manufacturing showed a slight growth of 0.7 percent, while the Leading index with -2.1 percent “signals no big positives changes in the near term.”

Hard economic days

It is widely known that employment is the best indicator of economic health. During the first quarter of this year, Puerto Rico saw a drop in jobs as measured by the Labor Department’s Household survey (-23,000 jobs) and the Establishment survey, with 2,100 fewer jobs when quarters are compared year-over-year.

On the other hand, Puerto Rico’s labor participation rate in March 2014 was 39.9 percent, compared to 40.7 percent in March 2013.

“The unemployment rate remained almost unchanged. Hence, private sector response to government initiatives does not signal real recovery yet,” the economist firm said.

Electricity consumption, another key economic driver, has been dropping in Puerto Rico since 2006 and has continued its spiraling trend so far this year. Meanwhile, electricity costs remain one of the leading causes for business bankruptcy. From 2010 to 2013, the number of businesses with Puerto Rico Electric Power Authority as a creditor grew from 21 percent of total bankruptcies to 28 percent.

“Higher fuel costs appear to have trickled down, exerting more pressure on small businesses,” the firm noted.

Consumers face higher bills

The island’s economic downturn is forcing consumers to engage in cautious consumption, confirmed by the Consumer index, which showed 0 percent growth for the first quarter. Gasoline sales increased 9.4 percent while department store sales fell 4.9 percent and car dealers sold 863 fewer units. However, retail sales grew 1 percent.

“Consumers have to make discretionary spending cuts to pay increasing fixed costs, such as, electricity and water bills. Businesses in Puerto Rico are also experiencing the same pressure from electricity bills plus the burden of additional taxes,” the firm said.

Construction in ‘wait-and-see’ mode

The island’s construction index fell 4.5 percent this quarter. Among its components, cement sales fell 9.3 percent, the value of construction permits slumped to –19 percent, and new housing permits declined to -19 percent. Despite an 8 percent growth in construction jobs, it accounts for 42,000 employees as of March 2014, compared with 94,000 as of March 2006.

“Fewer consumers are less willing to buy or they simply do not have the resources to buy. Banks are also more cautious in granting loans. However, some sectors are willing to invest,” said the consulting firm in its assessment of the quarter’s performance.

Manufacturing tries to diversify

The island’s manufacturing index grew 0.7 percent. Despite a loss of 1.6 percent in jobs, its payroll and number of working hours grew 7.2 percent and 2.0 percent, respectively, during the first quarter. Manufacturers are not hiring more employees but they are using over time.

The sector also posted 3.6 percent growth in exports. Overall, companies are adjusting their operational costs to deal with the economic panorama.

Banks feel the recession

The banking index continued a “dangerous downward trend” during the quarter, H. Calero Consulting Group said, posting a 2 percent drop.

“Four out of its seven components were negative: deposits fell 1.9 percent; credit cards, personal loans and real estate loans plunged to -1.9 percent, -0.8 percent, and -11.4 percent, respectively; auto, industrial and commercial loans grew 5 percent and 6 percent, respectively; and total capital also grew 4 percent,” the firm said.

During the first two months of the year, the sector experienced a couple of significant events. In January, the Government Development Bank announced it would transfer $2.8 billion in public funds from commercial banks to its own coffers, a move that apparently did not hurt the industry.

Then in February, Moody’s Investors Service began a revision of the three principal commercial banks —Banco Popular, Banco Santander, and FirstBank — focused on the possible deterioration of the economy, the government’s fiscal condition, and its effect on banks.

Calero forgot to mention one important metric: ‘Sense of Urgency’, which is also stagnant.