Economist: VAT could lead to uncertainty, high inflation

The implementation of a value-added tax system in Puerto Rico to replace the current sales tax structure could have a number of consequences — from uncertainty to high inflation to lower than expected fiscal revenue — that have yet to be publicly discussed, economist firm H. Calero Consulting said in its most recent “Economic Pulse” publication.

“Much has been said and speculated about the proposal to replace the current sales tax with a new value-added tax. The arguments for and against it have so far filled media outlets, sometimes with contradictory facts and figures. Moreover, the very nature of the VAT makes it a more complicated and technically involved scheme than the current sales tax,” said the publication.

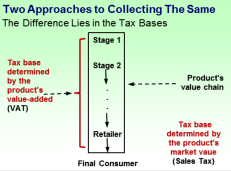

By definition, there are fundamental differences between a sales tax and a VAT, as the first is paid once and submitted to the government upon the final sale of goods and services, while the latter is a tax that is paid both by the buyer and the seller and remitted to the government at different stages. Both affect consumption, but are applied differently.

“In theory, the monetary value of both taxes should be the same if they are levied at the same rate. In practice, however, the VAT is significantly more cumbersome to administer. Since the VAT levies all economic transactions but is ultimately paid by the final consumer only, producers of intermediate goods and services must keep a record of all their VAT transactions,” the firm explained.

In its proposal, the government is reportedly considering a tax reform that will shift the burden from income to consumption. Many taxpayers would be except from filing annual tax returns, particularly those in lower income brackets, leaving the load on the shoulders of a reduced higher income population.

“As a result, low-income taxpayers would likely see a significant increase in their consumption taxes and not necessarily experience a net increase in their purchasing power. Most of these taxpayers would be trading off a proportionally higher cost of living for a small bump in their paychecks. And, if tax credits are included to counter the regressive nature of the VAT, then said taxpayers would still have to file income tax returns to claim them,” H. Calero Consulting said.

Because the proposed VAT is said to be fluctuating at between 14 percent and 16 percent, or more than twice the 7 percent sales tax in effect, prices for goods and services will likely face a one-time overall monthly increase of a minimum of 6 percent to 8 percent, which would lead to a subsequent permanent increase in the cost of living in Puerto Rico.

If a cascade effect takes place, prices rise by as much as 25 percent to 30 percent, which would deliver a direct hit on consumption, the firm predicted.

Another possible consequence of establishing a double-digit VAT that would drive up the cost of living is a surge in the migration rate, which is already at a runaway pace with an estimated 50,000 people leaving Puerto Rico during each of the last four years.

“The implementation of the VAT, at the rate that it is being proposed, could very well exacerbate migration, further eroding the already fragile business climate as well as the consumption tax base,” the firm warned.

“Whether the VAT ends up helping or hurting Puerto Rico in the long run will largely depend, however, on the final structure of the new tax regime, the efficiency in administrating it and the commitment and resources appropriated to develop it. Unfortunately, all of these remain open questions and anticipated risks are high,” H. Calero Consulting concluded in its publication.