Resident Commissioner introduces bipartisan bill to extend Child Tax Credit to P.R.

Puerto Rico Resident Commissioner in Washington, Jenniffer González-Colón addressed the U.S. House Floor Tuesday urging Congress to act on the extension of the Child Tax Credit for Puerto Rico. This proposal would inject more than $3 billion into Puerto Rico’s economy over the next decade, she said.

In Puerto Rico, most of the children live under poverty levels, she said. Fifty eight percent are living under the federal poverty rate, and 39 percent living under extreme poverty.

Puerto Rico’s child population has dramatically decreased over the last decade due to migration to the U.S. mainland, pressing to act on the situation that children are facing on the Island, she said.

González submitted the “Child Tax Credit Equity for Puerto Rico Act of 2019,” saying that under current law the Child Tax Credit only applies to families who are raising three or more children. In comparison, families living on the U.S. mainland are able to use the credit for having one or two children.

“Small families consisting of one or two children are excluded from receiving this necessary benefit. The purpose of the Child Tax Creditis to be a tool to help families offset the expenses of raising children and raise themselves out of poverty,” she said.

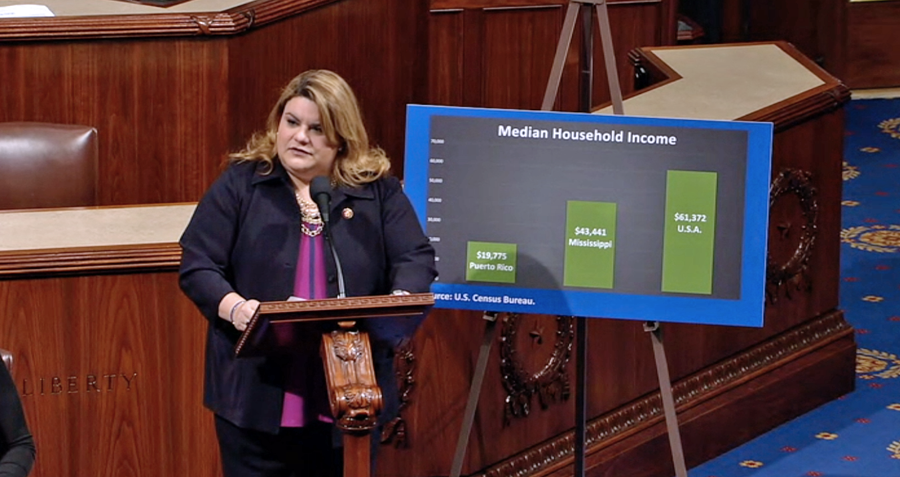

Mississippi has the highest poverty level of any state. Puerto Rico’s poverty rate, now at 45 percent, is 178 percent higher than Mississippi. According to the Census Bureau, Puerto Rico has the lowest household income at $19,775, compared to $43,441 in the state of Mississippi, and $61,372 nationally.

“This proposal would help Puerto Rico’s economy and benefit about 355,000 families and 404,000 children. I urge my colleagues to support and pass this bill,” she said during her turn on the floor.

Thes bill covers a recommendation of the Congressional Task Force on Economic Growth in Puerto Rico to minimize the challenges faced by Puerto Rican workers and maximize their opportunities.

Although most Puerto Rican families do not pay federal income taxes, they do pay federal payroll taxes. Currently, families in Puerto Rico can use these federal payroll taxes to claim the Child Tax Credit if they have three or more children. However, only 12 percent of families in Puerto Rico have three or more children, she said.

This proposal would pump some $3 billion into Puerto Rico’s economy over the next decade, benefitting about 355,000 Puerto Rican families and 404,000 children with an average annual household payment of $770, she said.

The bipartisan bill has the co-sponsorship of Rep. José Serrano (D-NY), Rep. Brian Fitzpatrick (R-PA) and Rep. Sean Duffy (R-WI).