Economist: GDB liquidation could be messy proceeding

A liquidation of the Government Development Bank for Puerto Rico could be a messy proceeding, because there is no precedent for determining how debt responsibilities and assets would be assigned, Economist and Professor Antonio Fernós-Sagebien predicted Wednesday.

If the Commonwealth’s fiscal agent — which currently has less than $400 million in liquid assets and is operating under a moratorium that has frozen all deposits — were to be shut down, a judge would likely have to step in to determine the “pecking order” of creditors.

The government has made no announcement of a possible GDB liquidation.

“In the absence of a legal framework to steer this, the only thing I see is that it will percolate. Who will get paid first, or next, I don’t know,” he said. “A judge could just declare it a loss.”

The process could be further complicated by the fact that the GDB’s charter law did not establish the hierarchy of creditors, namely bondholders and other entities such as municipalities and cooperatives that depend on it for financing.

“If this were like a regular bankruptcy proceeding, then you know more or less what to go by under the law. But this would be an unprecedented process in our judicial system,” he said.

Hence, the court could determine to establish a specialized hearing room for this and seek experts to steer the judge’s decision. Another possibility is putting the GDB’s assets on public auction.

“Local judges see foreclosures and bankruptcies all the time. But the GDB has it’s own law, so it remains to be seen how a court would work with that,” Fernós-Sagebien said, during the monthly luncheon of the University of Puerto Rico School of Business Administration Alumni Association, known as AFAE.

Individual bondholders preparing proposal

In related news, on Wednesday morning the recently created Backyard Bondholders Inc. confirmed they are preparing a proposal to present the government next week, looking to participate in ongoing debt restructuring talks.

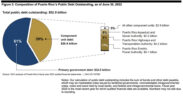

Jorge Irizarry, executive director of the nonprofit that represents some 50,000 individual bondholders who collectively own about $14 billion in Puerto Rico’s public debt, said the defaults the government has incurred in since last year are significantly affecting this group.

“We’re affected and we want to be part of the negotiating process,” he said, adding he met with Secretary of State Víctor Suárez last week, who opened the door for talks.

Individual local bondholders felt the impact of the government’s missed payments of bonds issued by the Public Finance Corp. last year, the Infrastructure Financing Authority in January, and the Government Development Bank’s $367 million default on Monday.

“Of that amount, we estimate that more than $100 million belong to Puerto Rican individual bondholders,” Irizarry said.