Despite the ups and downs it had in 2010, Banco Popular has been selected Puerto Rico’s “Bank of the Year” by “The Banker” magazine, a highly respected publication in circulation since 1926 and run by the Financial Times.

Banco Popular, a subsidiary of Popular Inc., last week celebrated 50 years of service in New York, where it opened its first branch in the Bronx in November 1961. Today, Popular ranks 36th by assets among U.S. banks, the company said.

Earlier this month, Banco Popular announced it had entered into an agreement with American Airlines Inc. to become the exclusive issuer of AAdvantage co-branded credit cards in Puerto Rico and the U.S. Virgin Islands. On Tuesday, both companies formalized the new partnership, offering details of the benefits now available to cardholders.

Banco Popular recently launched its newest institutional effort through which it seeks to inspire island residents to move forward and pursue their dreams through positive actions.

Banco Popular is launching today a yearlong celebration of its 30th anniversary of operations in the U.S. Virgin Islands, where it began doing business in 1981 through the acquisition of the assets of the Royal Bank of Canada.

Banco Popular announced Monday it has entered into an agreement with American Airlines Inc. to become the exclusive issuer of AAdvantage co-branded credit cards in Puerto Rico and the U.S. Virgin Islands, and the acquisition of the Citi/AAdvantage co-branded credit card portfolio, which represents approximately $130 million in balances.

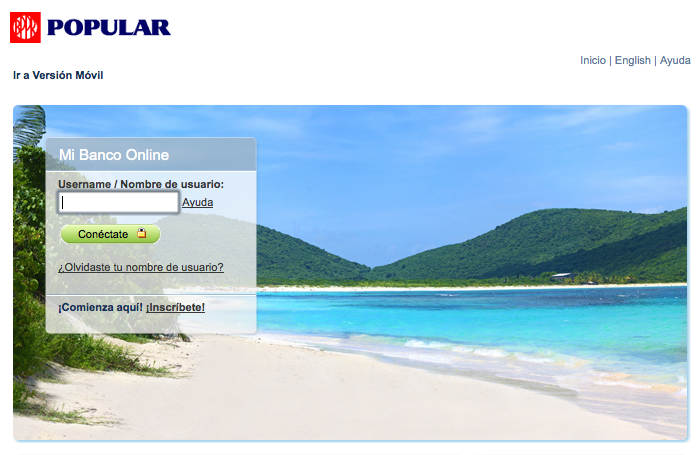

For the second year in a row, Banco Popular’s Internet platform has been included among the region’s best performers as per Global Finance’s Best Internet Bank Award 2011 competition. The bank received the organization’s “Best Bill Payment and Presentment” distinction.

Los Angeles-based financial research firm B Riley gave Popular Inc. a cautious pat on the back this week, saying the banking institution has “solidified its capital base, and it appears to be turning the corner on asset quality,” following several years of substantial losses.

Banco Popular de Puerto Rico will kick off the celebration of its 50th anniversary of service in the U.S. mainland with a lavish float at the National Puerto Rican Day Parade this Sunday.

Buoyed by a reduction in the island’s corporate tax rate and the sale of its equity stake in Consorcio de Tarjetas Dominicanas, S.A., Popular Inc. on Monday reported net income of $10.1 million for the first quarter ended March 31, an improvement over the net loss of $85.1 million during the same period the year before.

New York-based real estate auctioneer Sheldon Good & Co. and Banco Popular de Puerto Rico announced Wednesday an upcoming joint auction of 101 luxury residences and villas located in five developments throughout the island.

Puerto Rico’s main banks had more than $75.6 billion in combined assets at the end of 2010, reflecting a year-over-year drop of 15.6 percent, according to a report released by the Office of the Commissioner of Financial Institutions.

Popular Inc. sigue dando pasos para mejorar su balance general con el anuncio el lunes de que ha firmado una carta de intención no vinculante para vender aproximadamente $500 millones en préstamos para la construcción y bienes raíces comerciales. Alrededor del 75 % de los préstamos, que se venderán a su valor contable, son morosos.

Digital financial media company TheStreet.com this week included two local banks in its list of “Bank Stock Awards” winners, recognizing their respective performance improvements in 2010.

NIMB EN LAS REDES SOCIALES