A FiTiCAS study highlights systemic barriers and suggests comprehensive reform. #NewsismyBusiness

The proposal is consistent with the Puerto Rico Electric Power Authority’s fiscal plan, which reduces the fossil fuel budget by $400 million to $500 million per year to bring the utility out of bankruptcy.

Puerto Rico Gov. Ricardo Rosselló submitted his vision for a new tax model to the island’s Legislative Assembly aimed at encouraging work and create economic development through changes to the Internal Revenue Code.

La reforma fiscal recientemente anunciada debería incluir medidas para fomentar las empresas financiadas localmente y contener disposiciones destinadas a crear condiciones equitativas para las empresas locales, en particular las pequeñas y medianas empresas, afirmó Rodrigo Masses, presidente de la Asociación de Fabricantes de Puerto Rico.

With ongoing negotiations over tax reform, Members of the Congressional Hispanic Caucus Puerto Rico Taskforce sent a letter to Republican leaders in Congress urging the inclusion of tax provisions that will help rebuild Puerto Rico.

House Finance Committee Chair Rafael “Tatito” Hernández proposed Tuesday the full elimination of the value-added tax slated to go into effect on June 1, while unveiling a package of measures that would essentially “re-reform” Puerto Rico’s tax structure to provide balance.

The Senate approved Monday Bill 1256, which proposes overhauling energy subsidies and obliges the government to pay its debts to the Puerto Rico Electric Power Authority.

A year ago, as Puerto Rico welcomed the signing of the Energy Transformation and Relief Act of Puerto Rico (Act 57-2014), I shared my sentiment of great enthusiasm with friends, by quoting the extraordinary anthem of the Beatles 1968 “Revolution.”

Several prominent Puerto Rican economists urged lawmakers on Monday to exempt educational institutions from the proposed 16 percent value-added tax being discussed as part of a sweeping tax reform for the island.

El gobernador Alejandro García-Padilla anunció el miércoles la reestructuración del Departamento del Tesoro de Puerto Rico, y ofreció detalles sobre la reforma fiscal propuesta por la administración, expuesta en un proyecto de ley de 1,400 páginas presentado ante la Legislatura a última hora del día.

The Puerto Rico Treasury Department has spent the last seven months working with a team of local and international experts in tax, fiscal and economic matters to propose an overhaul to the island’s Internal Revenue Code that ultimately should eliminate the “uncertainty” associated with elements of the decades-old statute, agency Chief Melba Acosta told members of the media Thursday.

Some companies from the U.S. mainland operate in Puerto Rico directly vs. through Controlled Foreign Corporations. They pay federal income tax on their territorial income at the normal 35 percent rate.

Most manufacturing in Puerto Rico is done by subsidiaries of companies based in the States organized in foreign tax havens to avoid Commonwealth as well as federal taxes. Income of the subsidiaries is not federally taxed unless transferred to the parent company, when it would then owe the 35 percent corporate income tax rate.

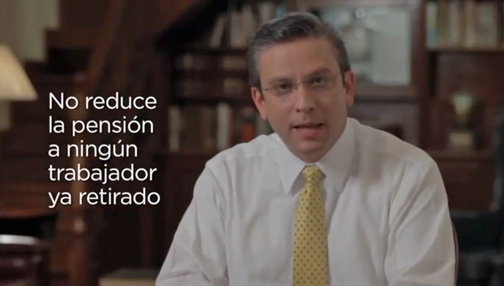

The Puerto Rico Senate approved late Monday the Teacher's Pension System reform bill submitted by Gov. Alejandro García-Padilla last week. The Senate's approval follows Saturday night's passage by the House of Representatives. The bill now goes to the governor's desk to be signed into law.

Amid outcry from many public workers who will see their pension benefits dwindle once they retire from their government jobs, Puerto Rican lawmakers approved and Gov. Alejandro García-Padilla signed a sweeping reform aimed at “rescuing” Commonwealth’s Employees Retirement System.

- 1

- 2

- Siguiente »

NIMB EN LAS REDES SOCIALES