IEEFA: New Fortress misleads investors in push for natural gas

The institute says this isn’t the first time the company has failed to keep its promises.

Shareholders of New Fortress Energy have filed notice of at least nine class action lawsuits against the company, alleging that it misled investors with respect to its “Fast LNG” project in Altamira, Mexico. The lawsuits allege that New Fortress failed to disclose to investors the many delays that were plaguing the project and the cost of those delays.

This is not the first time that New Fortress has failed to keep its promises to investors and customers. In its Q1 2024 earnings call, New Fortress discussed the possibility for expansion of its natural gas business in Puerto Rico, stating that it can expand natural gas usage to 300 trillion British thermal units (TBTU) of natural gas per year, nearly three times its current contracts of 105 TBTU per year.

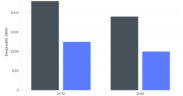

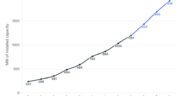

New Fortress further states that this 300 TBTU per year could be achieved with 2,960 megawatts (MW) of natural gas power generation running 80% of the time. That much natural gas power plant capacity would produce 20,744 gigawatt-hours (GWh) of electricity annually. According to the most recent electrical system fiscal plan, total electrical system sales were only 16,300 GWh in 2022 and sales are only expected to decline over the coming decades, reaching 10,000 GWh in 2035 and 6,200 GWh by 2050.

In other words, to realize the projections that New Fortress presented to its investors, Puerto Rico would have to import enough natural gas to generate over 30% more electricity than the total electric demand on the island for the foreseeable future.

New Fortress’ discussion also ignores the existing private 500MW EcoEléctrica gas plant on the south coast of the island, which would somehow have to be convinced to switch its gas supply to New Fortress for this scheme to work.

Furthermore, one of the plants (the Palo Seco Mega Gens) that New Fortress listed under “gas now” was not operating on natural gas. The plant did not have regulatory approval to start the conversion until six months later. Conditional approval was received in October 2024 with the actual conversion and startup date dependent on further regulatory action.

Under New Fortress’ statements to its investors, Puerto Rico would: 1) Be substantially oversupplied with natural gas — perhaps as much as 130% of total island electricity demand; 2) receive revenues from a plant that did not possess regulatory approval; and 3) ignore the existing capacity of 500 MW from the existing, operating EcoEléctrica plant.

New Fortress summarized its natural gas hopes for Puerto Rico, saying: “[We] expect … the island to be powered simply by natural gas supplemented with solar and battery and that is going to be Puerto Rico’s future…. [T]here’s complete alignment between our strategy, public policy and just the sheer economics of what will happen.”

The actual numbers that New Fortress is presenting would have the island powered by over 100% natural gas, in complete contradiction of Puerto Rico’s public policy of 100% renewable energy by 2050.

In terms of “sheer economics” it is worth noting that New Fortress has never produced any documentation of savings to Puerto Rico ratepayers materializing from its conversion of the San Juan power plant to natural gas — a project which it initially told the SEC would save $285 million a year.

New Fortress’ recent statements regarding Puerto Rico are part of the same pattern of exaggeration and overblown claims that are driving shareholders’ class action lawsuits.

Co-author Tom Sanzillo is the director of financial analysis for the Institute for Energy Economics and Financial Analysis (IEEFA.) He has produced influential studies on the oil, gas, petrochemical and coal sectors in the U.S. and internationally, including company and credit analyses, facility development, oil and gas reserves, stock and commodity market analysis, and public and private financial structures. Comments to [email protected].

Co-author Cathy Kunkel is an energy consultant at IEEFA. Comments to [email protected].