Oriental unveils online mortgage application platform

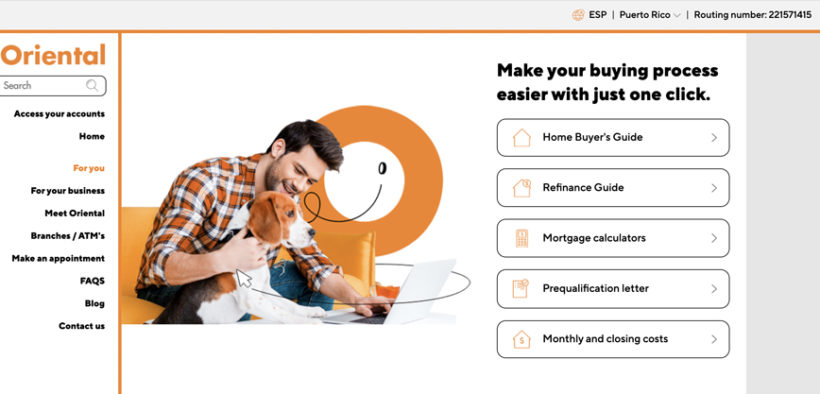

Aware of the high demand for mortgages and to expedite the process of qualifying for a mortgage loan, Oriental has developed a new digital solution for the benefit of those who are applying for a mortgage or refinancing a property.

The new option streamlines the mortgage prequalification process, provides information about the process, and provides a personalized estimate of mortgage costs and payments, bank officials said.

“For the first time in Puerto Rico, those interested in buying or refinancing a home will be able to obtain a mortgage prequalification letter through an automated and personalized system available on our sitio web,” said Idalis Montalvo, vice president of marketing and public relations for Oriental.

“Until now, people had a mortgage calculator available, but now we’ve added a new digital option through which they can get a prequalification letter, view information about the mortgage process, and receive a preliminary estimate of closing costs,” she said.

“In addition, we are the first to offer a calculator that helps you calculate the maximum sale price you can afford based on your income and debt,” Montalvo said.

The prequalification letter is the required first step in the mortgage financing process. Additionally, many real estate brokers require it as the first step in buying a property. Sometimes this process can take months and be difficult for people to get, bank officials said.

So, Oriental developed an option, available in Spanish and English, for interested parties to enter the required information and get that prequalification letter with one click. The page is also formatted to work on mobile devices.

“As part of this initiative, we also consider it essential to share knowledge and explain the mortgage processes in a simple way, that’s why there is a new section called the Learning Center where the client will find information, which will make them more prepared before applying,” said Carlos Del Valle, Oriental’s retail banking director.

This section includes specific details of the documents required to get a mortgage or refinance, as well as information relevant to how and why it is recommended or not to refinance a property, indications about the types of loans that are in the market, details about the interest rates in the market, the stages of the processes and other information.

The financial institution is launching an advertising campaign to support the new service.