La Fortaleza to file proposal in Congress to drum up investments

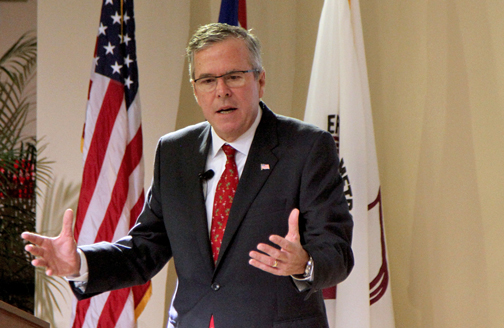

Gov. Fortuño discusses details of the PRIPA proposal as Resident Commissioner Pedro Pierluisi, left, looks on. (Credit: La Fortaleza)

Resident Commissioner Pedro Pierluisi will submit in Congress this week the proposed Puerto Rico Investment Promotion Act, which seeks to increase business investment and create jobs on the island.

During a Monday morning news conference at La Fortaleza, Pierluisi and Gov. Luis Fortuño offered details of the proposal, which has already garnered bi-partisan and private-sector support with the goal generating long-term economic improvement for the island.

“Rather than recycling the same ideas that were put forward by certain Puerto Rico leaders in recent years and that were not supported by the federal government, [Gov.] Fortuño and I have worked with tax experts in Puerto Rico and Washington to develop an original proposal,” Pierluisi said.

PRIPA would authorize — but not require — Puerto Rico corporations that earn at least 50 percent of their income on the island to elect to become domestic U.S. companies. In doing so, the companies would essentially receive the same federal tax treatment that Puerto Rico individuals receive under current law.

Specifically, these companies could be taxed on any income they earn in the states or foreign countries, but could exclude their Puerto Rico-source income from taxation.

Moreover, if it elects domestic status, a company could send, or “repatriate,” its profits in the form of a dividend to its U.S. parent company at very favorable tax rates, under Section 243 of the Internal Revenue Code. Profits that are repatriated to the U.S. can be used to increase investment and create jobs in the mainland U.S., rather than sitting idly in foreign banks.

“Far from forcing companies to reclassify, this project provides a new option,” Fortuño said during the news conference. “Also, we will not repeat the mistakes of similar measures such as Section 936, which lent itself to abuse by some companies and which was rejected by the federal Congress for precisely that reason.”

The company could also be eligible for a variety of business tax credits to reduce any federal tax it does owe, including credits for hiring certain disadvantaged workers and credits for adopting clean-energy technology. Currently, most Puerto Rico corporations operate as Controlled Foreign Corporations, or CFCs, and are ineligible for these important credits, Pierluisi explained.

“PRIPA reflects an effort to ‘thread the needle’ — that is, to craft a federal tax incentive that would provide a meaningful boost to the island’s economy, but also one that has a fighting chance of passage by the U.S. Congress in these challenging economic times,” he said.

“In the coming weeks, the governor and I will promote PRIPA in Congress and before the Obama Administration. In this endeavor, we will count on the support of the island’s business community, which has already been briefed on the proposal, and leaders of the minority party. We must stand united to help the island we all love,” he noted.

Monday’s announcement comes two weeks after members of the Private Sector Coalition voiced their support to the proposal that was brewing in La Fortaleza.

“We feel that this legislative change would be of great economic benefit to the island, by increasing our international competitiveness,” said Carlos Ubiñas, CEO of UBS Puerto Rico and member of the Private Sector Coalition. “In turn, I think it is a great example of what can be achieved when the private and public sector come together in pursuit of economic development of the island.”