Las cooperativas de crédito de Puerto Rico obtienen acceso al sistema del Banco Federal de Préstamos Hipotecarios

Puerto Rico Gov. Jenniffer González-Colón has signed into law Senate Bill 277, now known as Act 73-2025, aimed at expanding financial protections and benefits for the island’s credit unions.

The bill, introduced by New Progressive Party Sens. Juan Oscar Morales, Jeison Rosa and Jamie Barlucea, amends Act 255-2002, also known as the Savings and Credit Cooperative Societies Act. It authorizes Puerto Rico-based credit unions to become members of the Federal Home Loan Bank (FHLB) system, granting them access to its benefits.

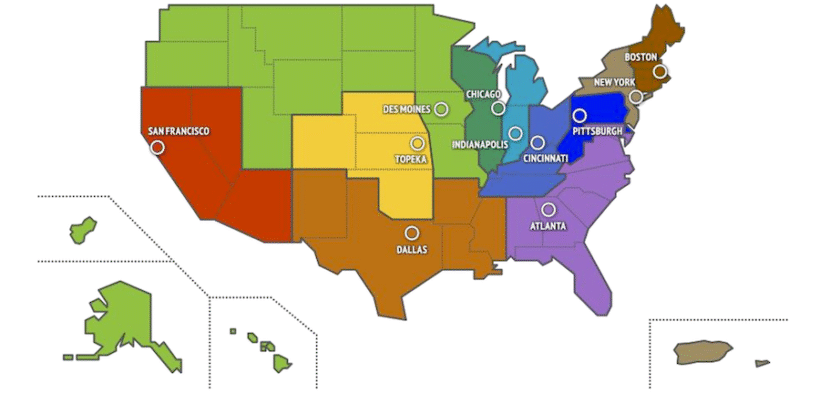

The Federal Home Loan Banks are 11 regional wholesale banks in the United States, cooperatively owned by about 7,000 financial institutions. Created by Congress, their mission is to provide reliable liquidity to support housing finance and community investment.

The law promotes collaboration between Puerto Rico’s Public Corporation for the Supervision and Insurance of Cooperatives (Cossec, in Spanish) and the FHLB in managing the restructuring or dissolution of distressed cooperatives. One of its key goals is to enhance coordination between Cossec and the FHLB to support credit unions facing liquidity challenges. The framework is designed to reduce the risk of failures, give Cossec more tools to rehabilitate institutions and lower the costs of managing or dissolving them.

Credit unions that become FHLB members will gain expanded access to favorable loan terms and a broader range of acceptable collateral. In cases of insolvency, FHLB-member institutions may receive targeted support in partnership with Cossec to help stabilize their financial condition.

The law affirms that Puerto Rican cooperatives can fully participate in the FHLB system, in line with its mission to provide affordable financial services, particularly in housing and community development.

“The FHLBNY wishes to extend these benefits to Puerto Rico’s credit unions because its mission … is aligned with the mission of the FHLB system,” the law states.

It also emphasizes the need for the FHLB to have flexibility to offer liquidity support during times of economic uncertainty.

Act 73-2025 updates Puerto Rico’s dissolution procedures for FHLB-member cooperatives, preserving the FHLB’s lien priority in asset distribution, except in rare cases involving fraud.

Unlike federally regulated banks, Puerto Rican credit unions are governed by local law, and this update aligns the process with national norms.

The measure is expected to encourage more cooperatives to join the FHLB system by reducing collateral requirements and fostering increased financial transactions between the FHLB and the island’s cooperative sector.

“These changes apply only to FHLB-member cooperatives and to collateral granted in the ordinary course of business,” the law notes.