Los alquileres en Puerto Rico se estancan mientras los ingresos y los costos del LIHTC alcanzan máximos históricos

Affordable rental housing in Puerto Rico is under increasing financial strain as operating costs rise, even as new national data show record rental income and net operating income for Low-Income Housing Tax Credit properties across the United States.

The latest Novogradac Low-Income Housing Tax Credit Income and Operating Expenses Report analyzed 193,783 LIHTC-financed units in the U.S. and found that median rental income, operating expenses and net operating income all reached record levels in 2024.

Puerto Rico, however, stands apart from most U.S. jurisdictions. The data highlight a widening gap between the island and the national LIHTC market.

Puerto Rico was among a small group of jurisdictions where median rental income declined in 2024, despite an 8.7% national increase in LIHTC rents to more than $12,000 per unit annually. The other jurisdictions reporting declines were Arkansas, Iowa, Missouri, North Carolina, Oklahoma, Virginia and the District of Columbia, according to the report.

The island also remained one of only four jurisdictions — along with Arkansas, Iowa and Oklahoma — where median LIHTC rental income stayed below $9,000 per unit in 2024. In 2016, 23 states fell below that level, underscoring how far Puerto Rico’s affordable housing rents have lagged over time.

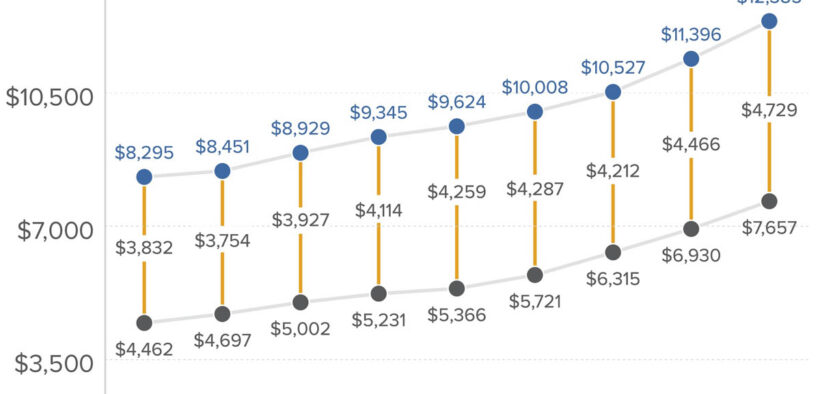

Nationally, median net operating income rose to $4,729 per unit in 2024, a 5.9% increase from 2023 and the highest level recorded in the nine years covered by the report. The increase followed two years of slight declines in 2021 and 2022, making the recent rebound notable for property owners and investors.

Operating expenses, however, continue to climb sharply. In 2024, median operating expenses increased 10.5%, outpacing both rental income growth and the national inflation rate of 2.9%. Over the past three years, operating costs per unit rose from $5,721 to $7,657, an increase of $1,936, or 33.8%.

While rising rents have helped offset these pressures, the challenge is more acute in Puerto Rico, where rent-restricted properties generate lower revenue while facing similar cost increases.

Insurance expenses and repairs and maintenance were identified as the fastest-growing cost categories, a trend with particular relevance for Puerto Rico given its exposure to natural disasters and aging housing stock.

Over the nine-year period covered by the report, the share of rental income consumed by operating expenses increased from 53.8% to 61.8%, narrowing margins for affordable housing operators. For Puerto Rico, where financial flexibility is already limited, that shift highlights the vulnerability of many LIHTC developments.

The report also found that LIHTC rental income growth continues to outpace market-rate housing. Market-rate rents increased just 0.8% nationally in 2024, according to Hemlane, while other trackers reported gains ranging from 2.8% to 5.1%. By comparison, LIHTC properties recorded an 8.7% increase in rental income, supported by high occupancy rates and lease renewals.

Geography remains a key factor in performance. LIHTC properties in large metropolitan areas generated more than $3,500 per unit in additional median rental income compared with nonmetropolitan properties, resulting in stronger net operating income. Properties in the Northeast and West also outperformed those in the South and Midwest.