Fed interest rate hike likely not to impact P.R. economy

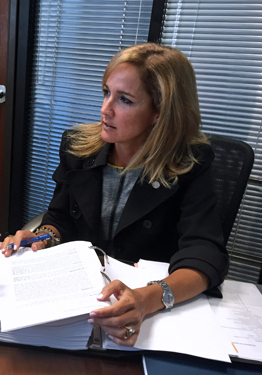

The decision announced Wednesday by the Federal Reserve System to increase interest rates by 25 basis points “does not represent a significant impact” on Puerto Rico’s economy or for bank customers, Puerto Rico Bankers Association Executive Vice President Zoimé Álvarez-Rubio said.

The Federal Reserve’s first rate hike in nine years is based on the strong growth of the U.S. economy, and will likely be the first of several to be introduced gradually next year.

“The economic reality that Puerto Rico is experiencing is not impacted by this decision by the Federal Reserve,” Álvarez-Rubio said.

“However, for years, our banks have been preparing to return to a standard interest rate environment. The Association’s member banks continue to manage interest rates risk, as well as ensure their ability to give and support the communities they serve,” she said.

The Federal Reserve’s announcement responds to information it received since the Federal Open Market Committee met in October, suggesting that the U.S. mainland’s economic activity has been expanding at a moderate rate. Positive behaviors in key indicators such as household spending and unemployment factored into the decision.

“The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data,” the Federal Reserve said in a statement released Wednesday.

Puerto Rico has been in an economic slump for the better part of the last decade, with negative growth and activity for most of that period, according to government data.