Moody’s: P.R. and its banks will benefit from federal economic analysis

The reason for the positive outlook is that Moody’s believes federal estimates of the island’s Gross Domestic Product “will bolster reforms by the island that should encourage unbanked residents to participate in the banking system, thereby spurring loan growth and increasing operating margins.”

In its report, Moody’s predicted that the banks that will benefit are Popular Inc., FirstBank and Banco Santander.

A report from the U.S. Government Accountability Office in 2016 that suggested that Puerto Rico’s data is “unreliable,” triggered the Bureau of Economic Analysis into action to create new economic indicators that will help analyze the island’s needs and serve as the foundation for long-term plans.

“Reliable economic data has been difficult to obtain since Hurricane Maria devastated Puerto Rico in September 2017, complicating efforts to both quantify the hurricane’s effect and develop useful reconstruction policy,” Moody’s noted.

The BEA will develop and publish estimates of consumer spending, business investment and trade in goods between 2012 and 2017, and that eventually these would feed into an overall GDP estimate to be published after 2019.

“Reforms laid out in the most recent version of Puerto Rico’s fiscal plan include policy changes designed to encourage greater participation in the formal labor force and reducing obstacles to starting a business,” Moody’s stated.

“Such measures are likely to encourage unbanked residents to participate in the island’s banking system, which would expand banks’ customer base and lead to loan growth and higher operating margins,” the firm predicted.

Robust economic statistics will also help determine the extent to which an economic recovery is occurring on the island, as evidenced by recent bank earnings, it added.

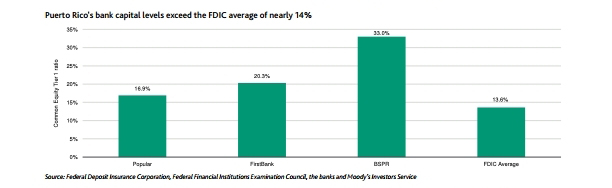

Puerto Rico’s banks reported improved financials for 2018, with Common Equity Tier 1 rations exceeding the Federal Deposit Insurance Corporation’s bank average of almost 14 percent as of the end of the fourth quarter of 2018.

“Improving the methodology of these economic statistics is also continued evidence of federal support for Puerto Rico,” Moody’s said.

“The current administration notes its commitment to the production of timely, unbiased data. But, as with other large-scale restructurings, reduction of local control curtails political pressures that are resistant to change, helping to clear the path for improved economic outcomes and implementation of new operational processes,” it added in its analysis.

Moody’s stated that the U.S. government’s initiative to take over data reporting is the most recent evidence of its efforts to support Puerto Rico’s change.

However, it also said the new data points may have negative consequences for the island’s current creditors.

“If BEA calculations reveal lower economic output than current projections, it may result in new debt affordability calculations with reduced resources available for creditors in ongoing restructuring negotiations,” Moody’s noted.