Op-Ed: OZ funds in Puerto Rico have a chance to spark real impact

As Opportunity Zones (OZ) continue to produce positive results for investors and communities, one area both fund managers and potential OZ investors may overlook is Puerto Rico. Ninety-eight percent of the island falls within Qualified Opportunity Zones, allowing communities across Puerto Rico to benefit from OZ investment.

Puerto Rico also offers advantages for investors who want to positively impact communities that need it most and who are looking for ESG investments outside of commercial real estate. Let’s take a look at why Puerto Rico is such fertile ground for OZ investment and how some funds are using OZ to prepare the island for a green future.

The advantages of Puerto Rico as an OZ destination

As an American territory, Puerto Rico has different taxation rules from the US mainland, specifically when it comes to business income and capital gains. Some of these incentives only apply to investors who reside in Puerto Rico, while others relate to corporations based on the island.

Thanks to a 2019 law called Act 60, residents of Puerto Rico who receive an Act 60 Investor Resident Individual decree can potentially pay a 0% capital gains tax rate on both short and long-term capital gains. For businesses, Puerto Rican corporations and LLCs are treated as foreign corporations for US tax purposes.

The corporate tax rate in Puerto Rico is an 18.5% normal tax plus a graduated surtax, with dividends taxed at 15%. Because of Act 60, businesses in some industries, including renewable energy, manufacturing, and agriculture, can qualify for a corporate rate of 4% and a dividend rate of 0%. There are also government incentives for creative industries, biotechnology, agroecology, and small businesses, among many others.

These incentives are dependent on the type of business, and there are specific requirements that must be met. But whether the investor is based in Puerto Rico or the US mainland, both investors and funds can benefit from the island’s tax incentives, including OZ.

Opportunities for impact

While potential tax savings can be enticing, they also come with their own set of complications, and may not be enough to attract investors on their own. OZ investors are looking for more than just tax incentives — they strive to make a real impact by putting their capital toward underserved communities.

Puerto Rico has suffered from high unemployment, which is why most of the island falls within a QOZ. Puerto Rico was also hit by hurricanes Irma and Maria in 2017, and 11 earthquakes since 2019. While there has been some government intervention, private investment will be necessary to rebuild the island’s infrastructure and economy.

Helping communities like these is exactly why the Opportunity Zones initiative was created, allowing investors to find projects that do good while offering competitive returns and tax incentives. And while many traditional OZ funds are real estate-focused, Puerto Rico offers the chance to participate in other types of ESG funds.

Investments beyond real estate: alternative energy in Puerto Rico

In 2019, Puerto Rico passed Act 17, which will require 100% of the island’s energy to come from renewable sources by 2050. Currently, less than 3% of the island’s electricity comes from renewable sources. To achieve the mandated targets, more than $10 billion of investment in renewable energy will be required. One OZ fund has responded to the island’s need for green energy investments.

Monllor Capital Partners LLC was founded in 2018 by Jose A. Torres as a minority-owned alternative asset management and advisory firm based in Puerto Rico. Its mission is to make and facilitate tax-advantaged private equity investments in Puerto Rico following Environmental, Social, and Governance guidelines.

In 2021, MCP launched the Puerto Rico Opportunity Zone Fund, which is investing in renewable energy, sustainable businesses, and infrastructure in QOZs throughout Puerto Rico. As fund administrator for the fund, JTC is working to help Torres and the fund’s principals leverage their more than 27 years of global experience and local presence on the island to offer quality investments among Puerto Rico’s 860 designated Opportunity Zones.

The fund’s first two investments are in Fusion Farms, the first indoor aquaponic farm in Puerto Rico, and Sunbeat Energy, a company that designs and sells renewable energy storage equipment for residential, commercial, and industrial customers. With these investments and more to come, MCP and PROZ are giving investors the opportunity to take advantage of OZ tax incentives while making a difference in Puerto Rico.

Challenges faced by funds looking to invest in Puerto Rico

While Puerto Rico has a lot to offer for OZ investors, many funds have avoided the island because of the challenges inherent in attracting capital and navigating the island’s tax complexity. Investors can be scared off by their unfamiliarity with Puerto Rico’s tax laws and the uncertainty of the island’s debt restructuring process.

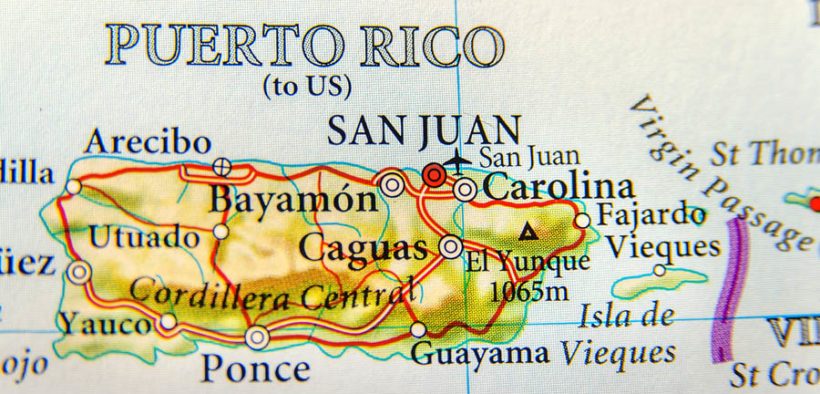

Another issue, according to Torres, is that many investors are completely unaware that Puerto Rico has Opportunity Zones, let alone how many there are.

“Many OZ maps do not show Puerto Rico,” he said. “We need more fund managers and investors spreading the word.”

With more exposure of the wealth of Opportunity Zones, potential tax savings, and ability to make a lasting impact, investors will surely respond.

Opportunity Zones investors who care about impact shouldn’t overlook Puerto Rico. Ninety-eight percent of the island falls within Qualified Opportunity Zones, and some funds in Puerto Rico are finding ways to use OZ capital to build a sustainable future for underserved communities on the island.

Disclosure: JTC Americas serves as a fund administrator to Monllor Capital Partners LLC.