Op-Ed: The 8 covenants every investor should know about Dow Jones Industrial average

With so much market volatility, we thought it essential to discuss some key elements investors follow every day and how it all works. We begin with the Dow Jones Industrial Average.

Since the Dow hit the elusive 36,000 mark on Nov. 5, 2021, when it closed at 36,327.95 and has been on a downward spiral since then, when you consider last Friday’s May 13, 2022, the closing of 32,196.66, it has fallen 4,131.29 points or 11.37%. As the Dow Jones Industrial Average crossed the 36,327.95 level, we analyze how it took to take the Dow from 20,000 to this record level.

- The Dow Jones closed above 20,000 on January 25, 2017, at 20,068.50.

- The Dow reached 25,063.89 taking 24 months and three weeks to do so, on Feb. 19, 2019.

- Then it reached 30,218.26 taking 21 months and thirteen days to do so on Dec. 4, 2020.

- Then on Oct. 18, 2021, it hit the 35,258.61 mark in only 10 months and 14 days.

- The ride continued upward, and 18 days later, it reached 36,327.95 on Nov. 5, 2021.

- Then the combination of the Ukrainian war, Inflation fears, Interest rates cycle changing, and global economic slowdown took the Dow Jones on a ride downward to close at 32,196.66 on May 13, 2021, some 4,131.29 from its high.

As we consider the rise, bear in mind that it only took the U.S. stock markets 57 months and 11 days to make the Dow Jones rise from 20,068.50 to its high of 36,327.95, some 16,259.45, an 81.29% increase. As both economies and stock markets work in cycles, it was time for the process to fall at least a little.

As the Dow crossed from milestone to milestone, all were hyped, celebrated, advertised, and honored, among other things, by specialized media outlets such as Bloomberg and more mainstream media like CNN or NBC.

The Dow Jones is just an ordinary calculation: it is done by adding the prices of the 30 stocks that compose the average and dividing it by something called the “Dow Divisor.”

The so-called divisor is permanently being changed to maintain the Dow up to date, constantly adjusting the changes that include stock splits and dividends, among other factors.

However, have you considered their longer-term significance?

Should investors care?

The answer is both: Yes, and no.

Without considering the importance of any level of the Dow, whether 20,000 or 36,000, there are eight covenants every investor should know about the Dow Jones Industrial average.

- The Dow is more of an emotional constant: Most traders love the big and impressive numbers, preferably increasing, and so do most investors.

- The Dow Jones Industrial Average is not ideal when looking for analytical content: as the index covers a very narrow set of stocks and therefore lacks representation.

- Dow is heavily mentioned when it comes to headline information about stock market performance: You should know that it was not the only U.S. index flirting with record levels. The Standard & Poor’s 500 and Nasdaq were at or near their all-time highs, and both are better representations of the market.

- The economy is still in good shape, and corporate earnings continue rising; with the unemployment rate at 3.60% with more than 11.55 million new jobs open, our prognosis is that this economy will continue its trend upwards.

- The Dow, in perspective, is 36,327.95 enough? Due to the power of compound interest, 100-point — or even 1,000-point — swings in the Dow don’t mean what they used to ink about it this way: The Dow first crossed the 1,000 marks in November 1972. It would take more than 14 years for the Dow to gain the following 1,000 points, which was accomplished when it first broke 2,000 in 1987. In contrast, the Dow hit 19,000 on November 22, 2017, approaching 20,000 less than a month later. Also, consider that the Dow Jones rose more than 16,000 in less than five years.

- The Dow Jones focuses are large companies: as the Dow covers the large, top-flight, and best-rated companies primarily, it does not encompass the broader U.S. stock market, which also consists of small-and mid-cap stocks.

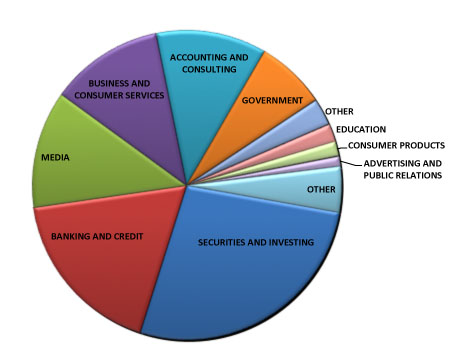

- Limited stocks and sectors: The Dow has just 30 U.S. stocks and only includes nine sectors of the economy.

- We shouldn’t pursue the Dow Jones as a diversification strategy: it’s time to rethink how to diversify, like bonds and U.S. Treasuries interest rise with equities weakening. So DJI is too narrow to be viewed as a diversification strategy. It is more effective to seek a diverse basket of investments to pursue a diversified approach.

We should have little doubt about the signaling outcomes. Every time The Dow Jones crosses a higher level, whether 30,000 or 36,000, it becomes front-page news. Most investors hope that these milestones will act as a steppingstone seeking diverse participation of the broad investor base, most notably millennials since they focus on growth in the new investment world.

After all, increasing the investor base contribute to a fundamentally healthy and less volatile market. It may take a lot more than headlines and social media likes for this to happen in the current downward environment. We recommend that every investor invests with well-determined financial goals, always having a properly diversified portfolio of stocks, bonds, and other instruments, considering your time horizon, and risk tolerance levels. In comparison, it is crucial to understand that the markets work in cycles, and today’s paper loss could become an outsize gain.

Lastly, always remember “The first lesson of economics is scarcity: There is never enough to satisfy everyone who wants. The first lesson of politics is to ignore the first lesson of economics.” Thomas Sowell.