Op-Ed: The weak links in the Global Supply Chain

Out-of-stock, higher pricing, empty shelves, longer shipping times, rising shipping costs, and labor shortages, and now the Christmas season is adding the Black Friday specials. All these issues act in tandem, impacting the once stable producer/consumer relationships into a twilight zone.

The preferred response by most is that the Global Supply Chain is both weak and broken. We have been listening to anecdotal reports of increasing prices, and out of stocks of all kinds, all fingers point to a weak and broken supply chain,

However, do we specifically know which parts of the chain are the causes of the world’s problems?

Let’s examine five of the links of the Global Supply Chain to understand the situation better.

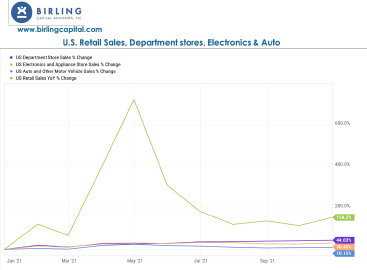

Weak Link 1: The unexpected increase in retail sales: As the world closed, retail sales fell dramatically during 2020. Most businesses, from automobile manufacturers to department stores, got ready for a prolonged recession due to the exogenous shock caused by the COVID-19 pandemic. In less than 90 days, the world experienced the fasted economic rebound in recent history. This unexpected rise created the first weak link in the global supply chain.

“Fatigued Inventories” as we look at the data, we see that the Retail Trade Inventory-to-Sales Ratio decreased to just 10% of supplementary inventories on-site for each sale, compared to the average 50% cushion. As manufacturers dealt with the prospects of a prolonged recession, the sharp rise in demand has created problems that generations have never experienced.

Weak Link 2: Manufacturers fight to meet the rising consumer demand: While it may take several minutes for a consumer to make up their minds on a purchase, it does not work that way for manufacturers. When manufacturers plan their outputs, they do so in carefully built forecasts. At the height of the pandemic, most factories either halted production or dramatically reduced it. So to meet the rising demand, most manufacturers had to source their raw materials from whatever source at whichever prices, causing the Producer Price Index (PPI) to rise above the long-term average of 0.18%.

The last ten months of the PPI show a strain that causes the year-over-year US Producer Price Index to rise to 8.62%, or 351% higher than the long-term average of 1.91%.

China, the world’s factory that generated everything from raw materials to produce final products to consumer products, has not met the global demand. We also suspect that China has had more significant problems with COVID-19 that it has been willing to admit. Most manufacturers working on short lead times have been forced to increase their lead times by six to seven times longer.

Weak Link 3: Shipping costs become cost-prohibitive: As manufacturers increase production, shipping those products out becomes another challenge in the supply chain. We have seen the Ports of Los Angeles and Panama, among others, with hundreds of ships carrying up to 8,500 containers per ship, jamming those ports creating bottlenecks that anyone could remember ever seeing. Also, the cost to ship a container from China that would cost about $4,500 has risen to north of $23,000. After many months of closed ports and furlough employees, no one in the shipping industry could have planned for the scenario we are seeing now.

Weak Link 4: Lack of Labor goes global impacting the supply chain: With US job openings at 10.44 million up 57.89% from one year ago and the unemployment rate of 4.60%, most companies cannot fill millions of job vacancies. Initially, at least in the US and Puerto Rico, most employers thought that workers were not coming back because of the Pandemic Unemployment Assitance (PUA) benefits, which in essence gave any worker getting $8.50 per hour a salary raise to $23.

But no, it seems the pandemic caused a much more significant impact on the mindset of millions worldwide seeking a better life balance, more flexibility, and improved working conditions. Additionally, most businesses have been forced to increase their per-hour salaries to lure workers back, directly impacting inflation. As the labor shortages persist, we note that crucial areas of the world’s supply chain, including transportation, manufacturing, and distribution, have been heavily impacted by the disruptions.

Weak Link 5: Consumers are the root of the problems: As we combine the first four weak links of sales increases, manufacturers strain, shipping costs, and labor shortage with unusually high consumer demand, the result is a drastic increase of inflation that translates to the good we purchase most of all.

We note that the one-year-ahead inflation expectations for the US is at 5.31%, compared to 2.98% last year and much higher than the average of 2.93%. If consumer demand continues to outpace production, inflation will continue rising. Also, as employers pay increased salaries to fill the labor shortages, this too will impact the inflation levels, which translates that higher prices may be among us for quite some time.

Finally, if prices trend higher, consumers will ultimately delay or reduce their purchases, impacting the economy. When analyzed as an ecosystem, we all realize that ultimately, the consumer has forced the supply chain disruptions.

Finally, the three main sectors most impacted by the global supply chain disruptions have been: automobile manufacturers; housing; and computer chips.

The broader question is, how do we fix a weak and broken Global Supply Chain?

Only when supply outpaces demand or at the very least when supply reaches a balance with demand will we begin to see the repair of the Global Supply Chain.

The key for all parties involved is to return to the normal stability, balance, and availability with a high sense of certainty; only then we shall see the Global Supply Chain return to its balance.