Op-Ed: US vs. Puerto Rico banks, who’s ahead in ’22 and why?

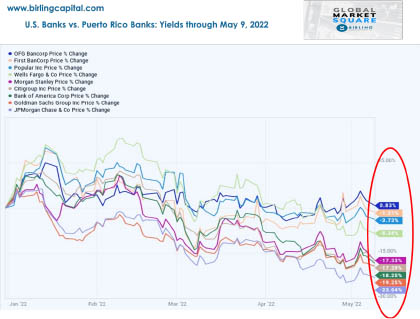

We begin our analysis by examining the top 6 U.S. Bank holding companies, part of the Birling Capital U.S. Bank Index. We discuss how each bank holding company’s stock has fared from Jan. 1 to May 9 and compared to the Dow Jones, S&P 500, and Nasdaq and how they have managed against the Birling Capital U.S. Bank Stock Index.

The returns of these four indices are as follows:

- Dow Jones Industrial Average -11.26%

- S&P 500 -16.26%

- Nasdaq Composite -25.71%

- Birling Capital U.S. Bank Index -16.77%

The Birling U.S. Bank Index has a return of -16.77% year to date in 2022, and when pegged against the other indexes, the Birling U.S. Bank index beats the S&P and Nasdaq. Let’s see how each Birling U.S. Bank Index

company has performed individually and against the major indexes.

- Wells Fargo & Co (WFC), Achieved a total return of -8.38%, beating the S&P, Nasdaq & Birling U.S. Bank Index handsomely. The Stock price on May 9 was $43.96 and had a price target of $62.55.

- Morgan Stanley (M.S.), Achieved a total return of -17.33% beating the Nasdaq & Birling U.S. Bank Index. The Stock price on May 9 was $81.15 and had a price target of $111.58.

- Citigroup Inc. (C), Achieved a total return of -17.39% that underperformed the Birling U.S. Bank Index, Dow Jones, S&P, and beat the Nasdaq. The Stock price on May 9 was $49.89 and had a price target of $70.50.

- Bank of America Corporation (BAC), Achieved a total return of -18.25%, beating the Nasdaq. The Stock price on May 9 was $36.37 and had a price target of $50.95.

- Goldman Sachs Group (G.S.), Achieved a total return of -19.25% beating the Nasdaq. The Stock price on May 9 was $308.89 and had a price target of $434.69.

- JP Morgan Chase & Co. (JPM), Achieved a total return of -23.04% lagging the Birling U.S.Bank Index, Dow Jones, and S&P 500 but beating Nasdaq. The Stock price on May 9 was $121.86. and had a price target of $167.68.

The Birling Capital Puerto Rico Stock Index has a return of -6.43% year to date in 2022.

Now, let us revise the results for a year that began in 2022 is much more robust than anticipated. The three bank holding companies that make up the index have stood up well and better than those stateside and are in a much better position. We review each of the banks in that light, analyzing their performance from Jan. 1 to May 9. The Birling Capital Puerto Rico Stock Index has a return of -6.43%, which beats them all compared to the other indexes. The Dow Jones has -11.26%, S&P 500 -16.26%, and Nasdaq Composite -25.71%, and Birling Capital U.S. Bank Index -16.77%.

Now let’s take a look at each stock and its returns:

- OFG Bancorp. (OFG), Achieved a total return of 0.83%, beating the Dow, S&P, Nasdaq, Birling U.S. Bank Index, and Birling P.R. Stock Index. The Stock price on May 9 was $26.78 and had a price target of $33.53.

- Firstbank Corp.(FBP), Achieved a total return of -1.31% beating the Dow, S&P, Nasdaq, Birling U.S. Bank Index, and Birling P.R. Stock Index handsomely. The Stock price on May 9 was $13.60 and had a price target of $17.88.

- Popular, Inc. (BPOP), Achieved a total return of -3.73%, beating the Dow, S&P, Nasdaq, Birling U.S. Bank Index, and Birling P.R. Stock Index. The Stock price on May 9 was $78.98 and had a price target of $110.92.

As you can see, the Birling Puerto Rico Stock Index at -6.43% beats the Birling U.S. Bank Index at -16.77% by a handsome margin. It is worth looking at the Puerto Rico stocks as part of a well-diversified portfolio of stocks, bonds, and other securities that are part of your long-term financial goals.

Why are the Puerto Rico banks performing so well during these times of volatility?

- Puerto Rico’s economic engine: is firing on all cylinders; the annual Gross Domestic Product economic activity number of 2.60% is quite robust, as is also the Economic Activity Index, which is at 3.50%.

- Sales of bags of cement pace up: Cement sales increased from 1,176,900 to 1,472,900, increasing 25.07%. This translates into a significant increase in activity for the entire Construction Sector and the much-anticipated rebound.

- Reduction in Unemployment and increase in the labor participation rate: the unemployment rate was reduced to 6.50%, a decrease of -4.41% from 6.80% in one month. In addition, the labor participation rate increased 0.90% over the past month, rising from 44.30% to 44.70%. Non-farm wage and salaried employment in Puerto Rico, not seasonally adjusted, rose last month to 908,200, an increase of 2,000 jobs

- Puerto Rico’s manufacturing PMI: increased from 56.00 to 57.90, a significant increase of 3.39% last month, which is very good news for the Manufacturing Sector with a collective investment of more than $500 million, which will contribute to expanding this growth.

- Implementation of the Debt Adjustment Plan: reduced Puerto Rico’s debt from $70 billion to $34 billion, a discount of 51.42%. In addition, a reduction of the annual debt payment from $3.9 billion to $1.15 billion per year. The Plan saves Puerto Rico 70.50% in annual debt payments.

- We see a governor highly active in promoting Puerto Rico as an investment destination: The governor appears highly active in attracting industries to Puerto Rico, meeting with hundreds of executives while participating in global forums outside of Puerto Rico. Most recently, during the Spain mission.

- The implementation of the Earned Income Tax Credit (EITC)– $612 million in annual funds for ten years ($6,500 per worker with income under $44,000 annually).

- Implementation of the Child Tax Credit (CTC)- $1.5 billion ($3,600 per child age six and under, and $3,000 age 6-17 per taxpayer). Granting the Nutrition Assistance Program (PAN): the PAN now increased by $463.8 million.

- The government’s response to COVID-19 and the focus on vaccination without politicizing the process is one of the administration’s greatest successes. Taking control of the COVID-19 pandemic, relaxing measures when warranted, and tightening them when necessary, as was the case during Omicron, has been a great success. The vaccination rate stands at 86.1% of the population.

- Puerto Rico has become a stable presence on Washington’s agenda: in critical areas like Medicare and Medicaid parity and rebuilding efforts. Reconstruction funds, previously withheld, are now being deployed; the influx to the Island includes $83 billion related to the hurricanes, $600 million associated with the earthquakes, and $15 billion associated with COVID-19. For a grand total of $98.6 billion, enough to build a second floor in all of Puerto Rico’s critical infrastructure and lead Puerto Rico into a future of significant progress.

However, there are several areas of concern:

- The elimination of the Foreign Tax or Act 154 creates an uncertain environment: The U.S. Treasury Department granted an additional transition year to companies under Act 154-2010. This law represents about $1.7 billion annually to the treasury. It is urgent to protect the tax base that these companies represent. The new tax should focus on migrating what the taxation of Law 154 produces to another type of tax that is similar in the collection and at the same time can be credited by the companies for their federal taxation, thus minimizing the loss of companies and jobs.

- Puerto Rico’s declining population: It is of great concern that the mortality rate is higher than the birth rate. According to the federal Census Community Survey, the population projection is around 3.1 million by 2025.

- Key issues impacting Puerto Rico’s entrepreneurs:

- 88% of all companies say inflation pressures have affected their business.

- 73% mention higher energy costs are negatively impacting their business.

- 73% of small businesses indicate that supply chain issues have negatively impacted their bottom line.

- 56% of Entrepreneurs understand that the economy has gotten worse.

- 45.6% cite tax burden as a factor.

- 45% have difficulty finding and retaining qualified employees.

- 44.1% believe that government bureaucracy impacts them.