Op-Ed: Who should file US individual income tax return?

Every U.S. citizen is subject to the provisions of the United States Internal Revenue Code (“USIRC”) regardless of their place of work or residence. Since people born in Puerto Rico are U.S. citizens, they are subject to the provisions of the USIRC.

Notwithstanding the above, most U.S. citizens who are residents of Puerto Rico are not required to file U.S. income tax returns due to the exclusion provided by USIRC Section 933 (1).

This statutory provision specifically provides that in the case of an individual who is a bona fide resident of Puerto Rico during the entire taxable year, income derived from sources within Puerto Rico shall not be included in gross income for federal tax purposes and shall, therefore, be exempt from U.S. income taxation.

Note, however, that the exclusion granted by USIRC Section 933(1) only relates to income from sources within Puerto Rico and that it does not exclude non-Puerto Rico source income from U.S. income taxation.

Therefore, a U.S. citizen resident of Puerto Rico who derives income from sources outside of Puerto Rico in excess of the minimum amount of gross income required to have to file a U.S. individual income tax return, will be obliged to comply with this responsibility, even if he/she is a bona fide resident of Puerto Rico for the entire taxable year.

Such individual’s U.S. income tax return should include all income from sources outside of Puerto Rico, while the income from sources within Puerto Rico would be excluded. Other income that should be included in such federal income tax return are income from federal employees, Social Security benefits, income in the form of interests from U.S. financial institutions and dividends from U.S. companies.

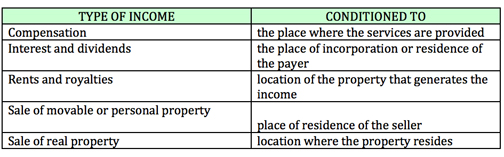

The general source of income rules are as follows:

Either the itemized deductions or the standard deduction to be claimed by the taxpayer excluding income under USIRC Section 933(1) shall be reduced in the same proportion that the excluded income bears to total income. The personal exemption and exemptions for dependents are not subject to reduction as a result of the excluded income.

The determination of whether or not a U.S. citizen qualifies as a bona fide resident of Puerto Rico who may enjoy the exclusion granted by USIRC Section 933(1) is based on the criteria set out in section 937(a) of the USIRC and the regulations issued thereunder. These criteria include, but are not limited to:

- The number of days that the taxpayer is physically present in Puerto Rico;

- Place where the taxpayer’s personal residence and effects are located;

- Place where the family of the taxpayer is;

- Jurisdiction where the taxpayer is registered to vote and where his/her driver’s license was issued;

- Jurisdiction where the taxpayer carries on banking transactions.

Since this bona fide resident of Puerto Rico shall also file a Puerto Rico individual income tax return reporting all of his income, they may claim a foreign tax credit (subject to certain limitations) against the tax liability determined for Puerto Rico purposes with regards to taxes paid to the U.S. in order to avoid double taxation of the non-Puerto Rico source income.

As a general rule, the minimum amounts of gross income required to have to file a federal individual income tax return for the year 2015 are as follows:

The due date for filing of the U.S. individual income tax return for the year 2015 is April 18, 2016. Always remember that a Certified Public Accountant (CPA) can help you with these and other tax matters.