Puerto Rico to start paying creditors again after 6 yrs. and massive debt adjustment

Puerto Rico is officially pulling itself out of bankruptcy today, as the terms of the Plan of Adjustment of the government’s debt goes into effect to resolve what is being defined as the largest public debt restructuring case in the US market.

The POA that US District Judge Laura Taylor Swain confirmed in January reduces the government’s prior debt of $33 billion to $7 billion, cutting the annual debt service repayment obligation to $1.1 billion, from $3.9 billion.

“The government of Puerto Rico had to prepare a very tight set of objectives that included 170 different tasks to make this day happen,” said Financial Oversight and Management Board for Puerto Rico Executive Director Natalie Jaresko during a virtual meeting with members of the media.

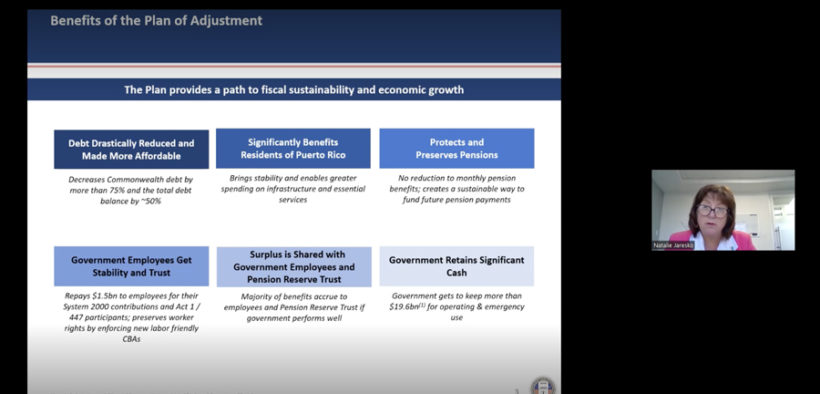

“The plan reduces debt drastically, brings stability to Puerto Rico’s finances, protects retirees from future mismanagement of their benefits, repays those who lost retirement money, shares budget surpluses with government employees, and allows the government to retain significant cash reserves,” said Jaresko.

In anticipation of the POA’s effective date, the government of Puerto Rico transferred $10 billion to a third-party service, Prime Clerk, which will be responsible for paying creditors.

“After nearly six years without paying debt, Puerto Rico can tell the market we’re back to making sustainable payments through a plan that allows us to be in a much better fiscal situation,” said Secretary of State Omar Marrero, who is also executive director of the government’s Fiscal Agency and Financial Advisory Authority (AAFAF, in Spanish).

“But this is still not enough. We’re working to apply financial management strategies in government by strengthening the Treasury Department and implementing a fiscally responsible culture,” he said, during a separate meeting with reporters.

In his presentation, Marrero explained that Puerto Rico will now pay approximately 6.5 cents of every dollar collected in taxes and fees from its residents to creditors, instead of 25 cents.

The plan also establishes a debt management policy that defines rules under which the government can borrow, allowing going to market to finance capital improvement projects but banning the use of such funds to balance the budget — a practice the government was into for decades.

As part of the new plan, the Commonwealth is required to comply with both the 15% and 7.94% debt limits when considering debt levels and issuances, Jaresko explained.

“The 15% constitutional debt limit includes General Obligation debt and is measured against a narrower revenue base, while incremental debt issuances are capped at 7.94% of the prior two years average debt policy revenues,” she said.

The POA also includes provisions to protect government retirees — refunding nearly $1.5 billion in payments to employees who contributed to the System 2000 formally establishes a Pension Reserve Trust that will be funded with $10 billion over time — and settles about $1 billion in claims to Puerto Rico residents and businesses, the Oversight Board explained.

In a prepared message, Gov. Pedro Pierluisi discussed the merits of the plan, saying “now we will have the certainty that we can fulfill our obligations and focus all our resources on providing the services that our people deserve, on growing our economy and creating the conditions so that every Puerto Rican has opportunities to reach their potential, that all and we can all achieve our goals here in our land.”

The path to bankruptcy

Puerto Rico filed for bankruptcy in the summer of 2017, when the Financial Oversight and Management Board for Puerto Rico sought protection under the US Bankruptcy Code’s Title III for the Commonwealth, the Sales Tax Financing Corp. (COFINA, in Spanish), the Housing Finance Authority, the Employees Retirement System and Puerto Rico Electric Power Authority (PREPA). All of that combined represented some $74 billion in debt.

However, over the five years, debt restructuring was completed for the HTA ($555 million), the defunct Government Development Bank ($4.7 billion), the Puerto Rico Aqueduct and Sewer Authority ($4.6 billion), and COFINA ($17 billion).