Puerto Rico’s healthcare sector ‘most exposed’ to coronavirus crisis

The Coronavirus pandemic will cause people to rethink existing values and will impact economic models going forward, a group of local and international experts gathered by Invest Puerto Rico during a virtual webinar concluded.

In Puerto Rico, where the economy has been limping along for the better part of the last 12 years, the already stressed healthcare system may be the most exposed by the crisis.

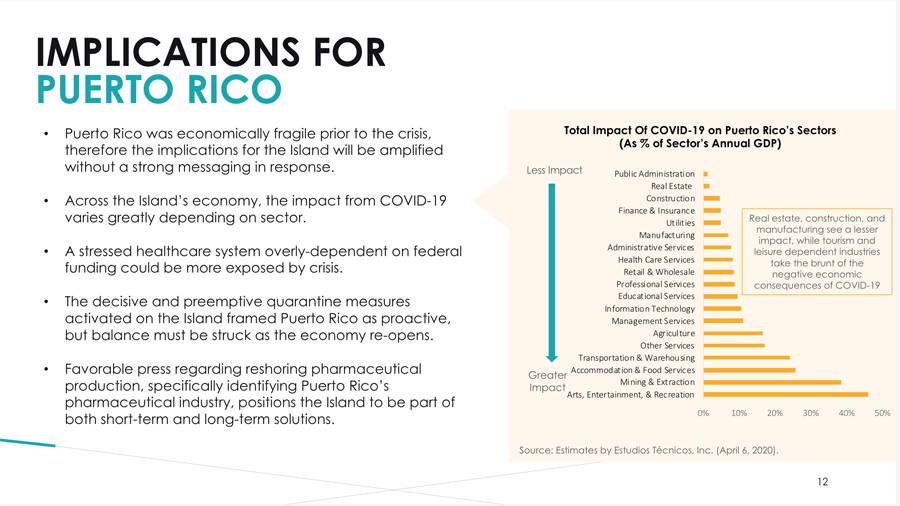

“Real estate, construction, and manufacturing see a lesser impact, while tourism and leisure dependent industries take the brunt of the negative economic consequences of COVID-19,” InvestPR revealed in the virtual presentation.

However, the movement to bring back pharmaceutical production to Puerto Rico, “positions the island to be part of both short-term and long-term solutions, the experts concluded.

“Manufacturing in a U.S. jurisdiction provides future assurance that the supply chain to the national market remains intact. Puerto Rico has demonstrated capacity given its history of pharma and medical devices on the island,” InvestPR officials said.

“We remain firm in our commitment to make way for a local economy that is sustainable, inclusive and competitive,” InvestPR CEO Rodrick Miller said. “The pandemic is a phenomenon that has altered global and local economic projections.”

“As part of our promotion plan, we already considered as a priority to monitor the market for radical changes that required adapting the promotion strategy so that we take advantage of the opportunities,” he said.

The virtual discussion served as a forum to learn more about the organization’s plans to advance stability and economic growth on the island, in addition to exposing the perspectives of the local and federal government on the implications of COVID-19.

“The moment we’re experiencing is a clear example of disruption that leads us to respond to the crisis and emerging needs in the global market,” Miller said.

“This event confirmed to us that, despite the challenges of the pandemic and others, Puerto Rico remains more resilient than ever and that behind each challenge there are opportunities to continue improving and growing,” he said.

The panelists for the “Building on Resilience” webinar included Miller; Jason Bram, research officer at Federal Reserve Bank of New York; Manuel Laboy, Department of Economic Development and Commerce Secretary; Ella Woger, COO of InvestPR; Chelsea Amelia Cruz, associate director of the FRBNY; and Matt Mullin, vice president for policy, programs and communications of the International Council for Economic Development.

During the discussion, the panelists shared data and projections about the short and long-term future for Puerto Rico and the world. Locally, the International Monetary Fund projects a 6.0% decrease in Puerto Rico’s gross domestic product for the remainder of 2020, with a slight rise of 1.5% in 2021. This forecast reflects what expected for the U.S. mainland (5.9% and 4.7%, respectively).

“Global projections all point to a dramatic reduction in general economic opportunity as a result of the coronavirus. The impact on Puerto Rico for 2020 will mirror that of the United States due to the interrelationship of the two economies — the outlook is less dramatic than in the Euro Zone, and similar to the rest of LATAM and the Caribbean,” Miller said.

“Longer-term, Puerto Rico’s outlook for 2021 is lower based on underlying economic challenges and the dependence on federal transfers and tax advantages,” he added.

Meanwhile, experts suggest there will be “a rethink of how much any country wants to be reliant on any other country,” forecasting potential protectionist trade policies.

They also believe remote work protocols established during the crisis will likely extend well after the crisis is over. Meanwhile, long-term disruption in business operations will cause many companies to rethink capital expenditure models.

“There will be a rethinking of how much a country wants to depend on any other country, so possible protectionist trade policies could emerge. Also, the remote working protocols established during the crisis are likely to be extended long after the crisis has ended. The truth is that long-term disruption to business operations will cause many companies to reconsider capital spending models,” the Fed’s Bram said.

Puerto Rico was economically fragile prior to the crisis, therefore the implications for the island will be amplified without a strong messaging in response, InvestPR concluded.