Study questions Medicare Advantage benchmarks for PR

A newly released study by The Moran Company, a Washington D.C. based health care research and consulting firm with extensive expertise in Medicare payment systems, has concluded that Puerto Rico’s traditional Medicare (also known as fee-for-service) population is not representative of the island’s much larger Medicare Advantage (MA) membership, questioning its use as the foundation for establishing MA benchmarks on the island.

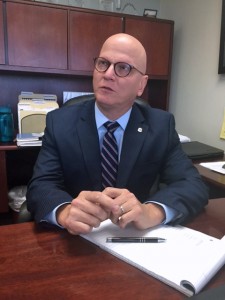

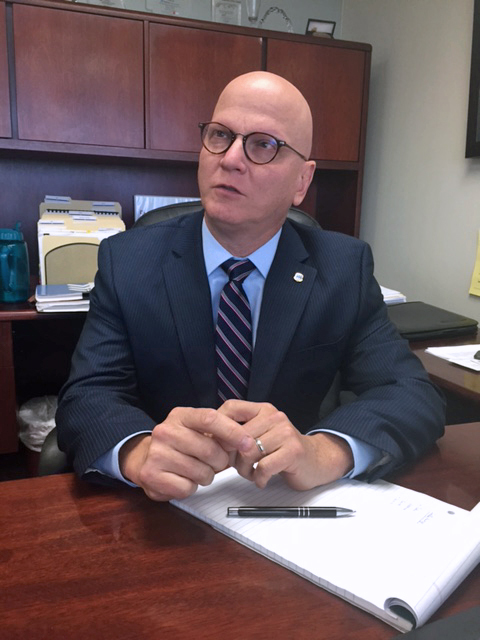

“This study provides strong evidence to support the Puerto Rico healthcare community’s longstanding call for administrative action by the Centers for Medicare and Medicaid Services (CMS) to adjust the benchmark so that it properly accounts for marked differences in size, composition and behavior between the island’s Medicare Advantage and traditional Medicare populations,” said Roberto García-Rodríguez, president of the Medicaid and Medicare Advantage Products Association of Puerto Rico (MMAPA) and CEO of Triple-S Management Corporation.

The report indicates that erosion in the fee-for-service (FFS) Medicare population, differences in characteristics and utilization patterns between Puerto Rico’s MA and FFS populations, and certain anomalies in the data that CMS uses to calculate MA benchmarks in Puerto Rico―along with Medicare policies in Puerto Rico that differ from the mainland― create selection bias.

“The net effect of differences in utilization and demographics for the two populations, historically depressed payment rates, and different Medicare services on the island compared to the U.S., leads to the conclusion that the FFS utilization under-estimates MA benchmarks,” the study asserts.

The study further concludes that the nature of the resulting selection bias may understate the Puerto Rico benchmarks to the point where “it will be increasingly difficult for the MA plans serving these populations to provide the level of service needed.”

Puerto Rico’s 2014 FFS enrollees who have both Parts A and B, which is the population used to set MA benchmarks, accounted for only 12 percent of the total eligible population, and has a much smaller proportion of dual eligible beneficiaries (10 percent) than the MA population (50 percent). This is markedly different from the rest of the nation, the study showed.

Puerto Rico is also unique across the nation in that MA enrollment exceeds 75 percent of the Medicare-eligible population (compared with a national average of 32 percent) and has been increasing every year, with 30 percent of Puerto Rico’s FFS population switching to MA annually (compared with a national average switch rate of 3-5 percent).

Utilization patterns between the populations are also quite distinct, suggesting access issues and differences in severity of illnesses that are not corrected by risk adjustment.

Lastly, historical differences in how the Medicare program applies in Puerto Rico compared to the mainland (e.g., Part D low-income subsidies are not available and partial dual status does not exist in Puerto Rico) depress historical FFS costs on the island.

As noted in the study, “If FFS beneficiaries are experiencing access to care barriers to getting the services they need, this will depress MA benchmarks and perpetuate inadequacies in the PR health care system, already challenged by depressed wages for health care workers and out-migration from the island.”

The MA benchmark in Puerto Rico, a national outlier, is currently $473 per beneficiary, or 43 percent below the U.S. average of $830, 38 percent below the state with the next lowest benchmark, and 26 percent below the U.S. Virgin Islands, another U.S. territory located less than 80 miles from San Juan.

CMS establishes MA benchmarks for counties across the nation based on the cost of serving the corresponding FFS population. Its benchmark methodology assumes that FFS utilization is generally representative of MA utilization, and existing risk adjustment models are not designed to correct for selection bias.

The assumption underlying this statutory requirement is that MA costs should not exceed that of the average FFS beneficiary.

Selection bias is increasingly likely, however, as the FFS population decreases, and at a certain MA penetration level, the methodology begins to break down. As the study points out, “the MA program relies upon risk adjustment to standardize benchmark calculations, but such reliance depends on the stability of the population and its size. The risk adjustment model is less reliable as the size of the population decreases and as it varies in ways not accounted for in the model. Both of these issues are prominent in Puerto Rico.”

CMS has no methodology to examine high MA penetration jurisdictions in order to evaluate the viability of its methods. According to the study, however, CMS has the authority to adjust its methodologies consistent with the overall intent of the statute, and should consider ways to correct the bias and establish a proper MA benchmark for Puerto Rico.

“Our commitment to future generations is to continually call on local and federal government leaders to unite on behalf of the Puerto Rico healthcare system and demand justice from CMS in its funding of the Medicare Advantage program for Puerto Rico’s 570,000 beneficiaries” said Jim O’Drobinak, MMAPA Board member and CEO of MCS.

“Permanent funding solutions are necessary to stabilize the Puerto Rico healthcare delivery system, which in turn is a necessary infrastructure component of Puerto Rico’s economic recovery. Everyone needs quality healthcare,” he said.

Broader policy questions on methodology

“While Puerto Rico represents an outlier in its high rate of MA enrollment, it is likely that there are or will be U.S. counties that approach similar levels of MA enrollment, raising the question of how and when to evaluate the representativeness of a FFS population as the basis for accurately estimating MA benchmarks,” the study indicates.

“This study provides conclusive evidence that selection bias occurs when MA penetration reaches a tipping point, and has important policy implications,” said Rick Shinto, MMAPA member and CEO of MMM Healthcare, LLC.

“Puerto Rico is the canary in the coal mine, and can serve as a case study for HHS and CMS to evaluate new policies and methodologies that adjust for a high probability of selection bias in counties with large MA enrollments,” he said.

“As MA penetration continues to increase across the United States, this need will also increase. We invite policymakers to work with the Puerto Rico healthcare community to find a better way — with the proper level of funding ― to provide quality care to our senior citizens,” Shinto added.

Call for action as funds dwindle

By the end of 2017, Puerto Rico will have lost approximately $4 billion in aggregate MA funding since 2011. These funding cuts have already resulted in substantial benefit reductions and increased pressures to reduce provider compensation, which has contributed to the loss of more than 3,000 physicians to the United States mainland since cuts associated with the Affordable Care Act began.

“The Moran Company study strongly supports MMAPA’s call in Washington D.C. for innovative policy solutions that address Puerto Rico’s deteriorating healthcare delivery system, which directly impacts more than 570,000 of Puerto Rico’s senior citizens,” said García-Rodriguez. “We need CMS to act now and adjust its methodology.”