Treasury collections fall $442M short of April estimates

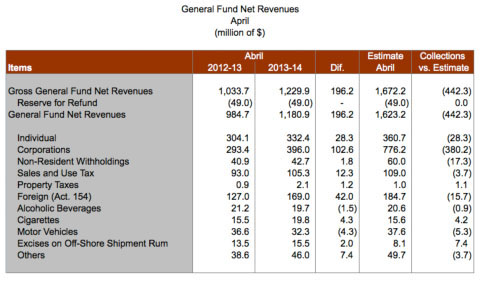

Puerto Rico’s revenue collections for the month of April fell significantly below estimates, short by $442.3 million at $1.18 billion, but up by $196 million year-over-year, the Treasury Department said in a release distributed after the end of business Friday.

The year-over-year difference represents a 20 percent increase, agency Secretary Melba Acosta said, noting that in April, when tax returns are filed, all the principal tax revenue sources reflected increases when compared to last year.

For the July 2013-April 2014 period, gross general fund net revenue collections also fell short of predictions by $355.9 million, the agency’s data shows. Still, agency officials said the $7.2 billion collected represented a 6.8 percent jump year-over-year.

“The increase this year is due to the revenue measures enacted as part of last year’s budget to reduce the fiscal deficit, specifically the gross receipts tax (‘patente nacional’), and the excise tax rate increase on foreign corporations,” Acosta said.

“While April 2014 revenues exceeded the prior year period, the amount collected was $442 million below estimates, with $380 million of that amount corresponding to the corporate income taxes line revenue. Year-to-date (July-April) revenues are below budget estimates by $356 million,” Acosta stated.

She noted that the corporate tax revenues are still being analyzed, and preliminarily attributed the fluctuation to a combination of factors that were identified after the tax return filing due date, April 15, 2014.

“We are looking closely at the corporations that requested extensions. We are analyzing the thousands of applications for time extensions that were not accompanied by payments (53 percent of all corporations), corporations that did not make estimated payments, and payments by corporations that were below expectations. The time extension for corporations is three months in duration and ends July 15, 2014. We will closely monitor this behavior until the extended deadline,” Acosta said.

Treasury is conducting an in-depth evaluation to take appropriate action, she said, with agency staff “carefully examining” information of the taxpayers in question and contacting those who, according to the agency’s records, should have filed their applications for time extensions with a payment, and did not, or paid less than they were required to pay.

Corporate taxpayers that filed applications for time extensions without a payment or with an insufficient payment could be subject to a surcharge of up to 10 percent, plus interest at a 10 percent annual rate.

Other factors that may have influenced the behavior of corporate taxes include: credits and other residual items from previous years that were higher than those taken into consideration in this year’s projections and reduced the tax payments, purchase of tax credits above projections, a timing difference in filing of tax returns by corporations as some close their books on dates other than Dec. 31 (e.g., corporations that close their books on Jan. 31 file their tax returns on May 15), the agency noted.

Meanwhile, Acosta said the $105.6 million, Sales and Use Tax collections reached the highest historic level for the month of April and for any other month except December and January. Moreover, the year-over-year increase in April, at 13.2 percent, was the highest for any month since the SUT was implemented.

“We believe this behavior is due to the combined result of several fiscal oversight strategies aimed at reducing tax evasion and enhancing the capture rate of the Sales and Use Tax,” she said.

During budget hearings last week, Treasury informed lawmakers that it continues to monitor the behavior of current fiscal year revenues— while the Fiscal 2015 budget is being considered — and its effect on estimates to keep them abreast of any changes.

While preparing the revenue estimates for the Fiscal 2015 budget, the Fiscal 2014 revenue base was already reduced by $537 million. Treasury is analyzing April revenues to determine whether they could impact Fiscal 2015 estimates, she said.

“The Treasury Department will continue working on a fair tax reform that simplifies tax processes and promotes economic development, and will continue strengthening oversight efforts to increase the capture rate and fight against tax evasion to attain the financial goals we have set. Puerto Rico faces difficult and extraordinary times that demand that we all fulfill our responsibilities and contribute towards the reconstruction of our island,” Acosta said.