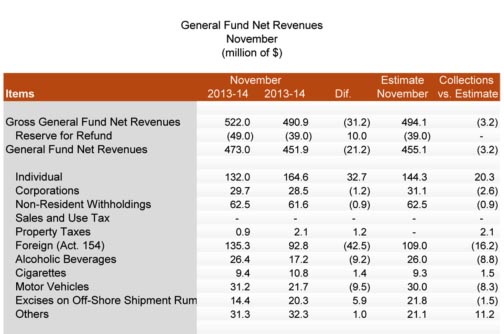

Treasury collections $3M short in November at $452M

The Puerto Rico Treasury Department announced Thursday that preliminary General Fund revenues totaled $452 million in November. This figure is $3 million, or 0.7 percent, below estimates, agency Secretary Juan Zaragoza-Gómez said.

The Puerto Rico Treasury Department announced Thursday that preliminary General Fund revenues totaled $452 million in November. This figure is $3 million, or 0.7 percent, below estimates, agency Secretary Juan Zaragoza-Gómez said.

The variation in total revenues is explained by the combined effect of the behavior of the main revenue categories, he said.

Individual income tax collections came in at $165 million, a $33 million, or 25 percent, increase relative to November 2013, and $20 million above estimates. This increase is due to the $27 million collected in connection with Act 77-2014, which granted a temporary period during which certain transactions could be prepaid, such as Individual Retirement Accounts, retirement plans and other capital assets. The temporary period ran from July 1, 2014 through Oct. 31, 2014.

For annuity contracts, the period runs from July 1, 2014 through Dec. 31, 2014. Revenues from these transactions total $137 million fiscal year-to-date.

“The governor is considering extending the deadline for the transactions related to IRAs and pension plans until Jan. 31, 2015, for the benefit of taxpayers who were previously unable to avail themselves of this law,” he said.

Meanwhile, he said there are two main reasons for the $43 million year-over-year decrease in the foreign corporation excise tax, viable through Act 154.

First, in October, one corporation under the law reached the maximum cap for the excise tax for the calendar year, as opposed to last year when it reached the maximum cap in December. Consequently, this corporation did not make any payments in November. This situation was taken into consideration in the estimates for the month.

Second, another corporation, for reasons inherent to its operations, moved forward its production to earlier months.

Fiscal year-to-date revenues in this category were up $34 million year-over-year and $6 million above estimates, he said.

On the other hand, the 6.0 percent state Sales and Use Tax (SUT) revenues reached $116.6 million in November, a $10.1 million increase, for a 9.5 percent year-over-year increase.

“SUT revenues were the highest for a month of November, since the SUT was implemented in November 2006. Fiscal YTD [July-November] SUT revenues totaled $414 million, for a year-over-year increase in adjusted revenues of 6.9 percent, or $36.9 million,” Zaragoza-Gómez said.

Treasury’s numbers show that certain excise taxes collections reflected a decline. Alcoholic beverage and motor vehicle excise taxes registered $9 million and $8 million reductions, respectively.

In mid-November, Gov. Alejandro García-Padilla signed into law Act 186, which lowers the excise tax on motor vehicles to 15 percent.

This bill launched some changes contemplated in the first stage of the tax reform, Zaragoza-Gómez said.