Triple-S Management Corp. has received 45 earthquake-related claims

Triple-S Management Corp. has received 45 earthquake-related claims and expects losses of approximately $8.5 million to its property and casualty line of business, company CEO Bobby García confirmed upon revealing the latest quarterly results.

In a call with analysts to discuss the fourth quarter results, García said the numbers for its Triple-S Propiedad division breaks down to $5.5 million in claims plus some $3 million in a reinstatement of its reinsurance program.

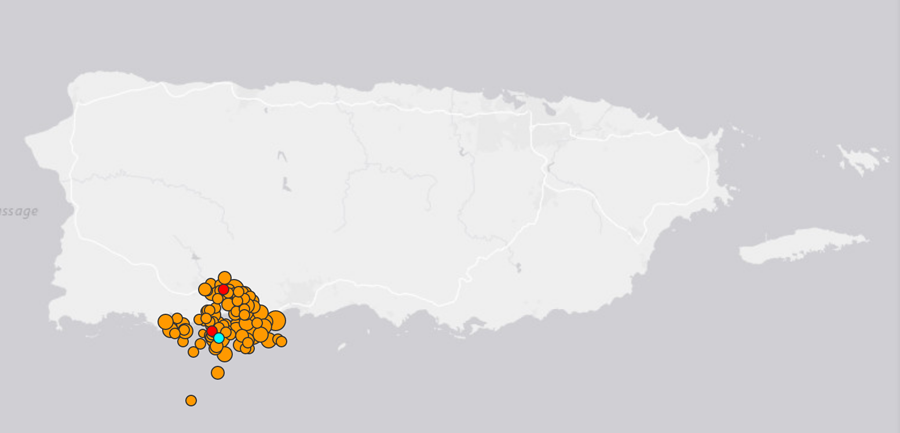

“[The earthquakes] damaged several hundred homes and other structures in the south and southwest of Puerto Rico,” said García. “Damages have been limited in scope. Loss estimates vary and the Puerto Rico government is still calculating the extent of damages. But its initial estimates put total earthquake-related island wide losses at $200 million.”

In an interview late last week with the “En Una Hora” radio program on 11Q 1140AM, Rafael Cestero, deputy commissioner of the Puerto Rico Insurance Commissioner’s Office, said local insurance providers had received 5,397 claims as of Jan. 15, 2020 representing $94 million in estimated losses.

“Of that some $3 million in claims have already been paid out,” Cestero said. “We believe numbers will increase because not everybody who has a claim, has been able to file it.”

In its earnings release, Triple-S also provided an update on its Hurricane María-related activity, confirming the subsidiary has paid a cumulative amount of $729 million in claims and expenses related to the 2017 catastrophe. Estimated gross losses remain unchanged at $967 million.

Triple-S Propiedad received 20 new claims and closed 84 claims during the fourth quarter of 2019, while 645 claims remain open.

Of the 645 claims that remain open, the company has been served with process in 313 cases and identified an additional 94 lawsuits that have been filed against Triple-S Propiedad that had not been served as required by law.

As for other results, Triple-S Management Corp. reported total operating revenues of $831.2 million for the fourth quarter, a 14.9% increase from the prior year, primarily reflecting higher Managed Care net premiums earned.

The company reported adjusted net income of $6 million, or $0.25 per diluted share, versus adjusted net income of $10.1 million, or $0.44 per diluted share, in the prior-year period, according to the earnings release.

“These results capped off a strong 2019 and exceeded the company’s initial expectations for both the top and bottom line, primarily reflecting solid growth in membership and premium rates across our core Managed Care segment,” García said.

Managed Care premiums earned were $741.6 million, up 15.3% year over year, according to the earnings release.

“2019 ended appropriately with a successful Medicare Advantage enrollment season that rendered more than 8,200 net new members as of Jan. 3, 2020. CMS is most recent membership report date. Importantly, our membership grew 16% year-over-year and we now maintain a 23% market share in MA, up 300 basis points from a year ago,” he said.

During the call, García said the company’s success was due to “innovative flexible products including equal menu plan that offers a choice of non-medical supplemental benefits as well as smart brand and sales strategies that adapted quickly to a very competitive field and focused retention efforts that managed to renew 93% of our existing members.”

He also said the fully insured commercial membership “continued its upward trend with a historically high retention rate of 98% and an increase of 37,000 member months in the fourth quarter, resulting in a 3.5% increase in premiums over the same period last year.”

“Looking ahead into 2020, we aim to further strengthen our core Managed Care products and membership rolls, particularly in Medicare Advantage and Commercial,” García said.

“We will also undertake additional initiatives to help ensure our customers continue to receive superior service, while keeping a watchful eye on medical cost trends and operating expenses,” he added.

“Overall, we remain focused on generating long-term growth by creating a unique value proposition and healthcare experience for our members in partnership with our provider community,” said García.