The Puerto Rico Treasury Department has spent the last seven months working with a team of local and international experts in tax, fiscal and economic matters to propose an overhaul to the island’s Internal Revenue Code that ultimately should eliminate the “uncertainty” associated with elements of the decades-old statute, agency Chief Melba Acosta told members of the media Thursday.

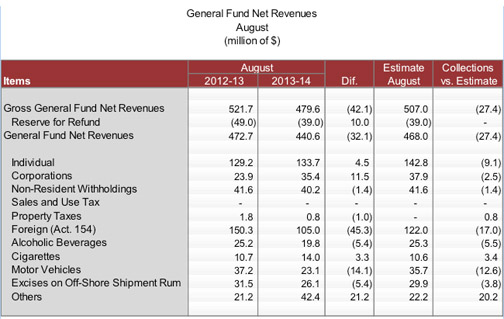

Puerto Rico’s General Fund net collections fell short of projected estimates by $27.4 million last month, when the government collected $440.6 million, hit mostly by a drop in payments from corporations under Law 154, motor vehicle sales and individual payments.

Puerto Rico’s auto industry skid into its seventh month of sales losses in August, when activity was down 20.1 percent in comparison to the same month last year.