The Puerto Rico Statistics Institute announced Monday plans to use a new method to collect information on households to measure unemployment in Puerto Rico.

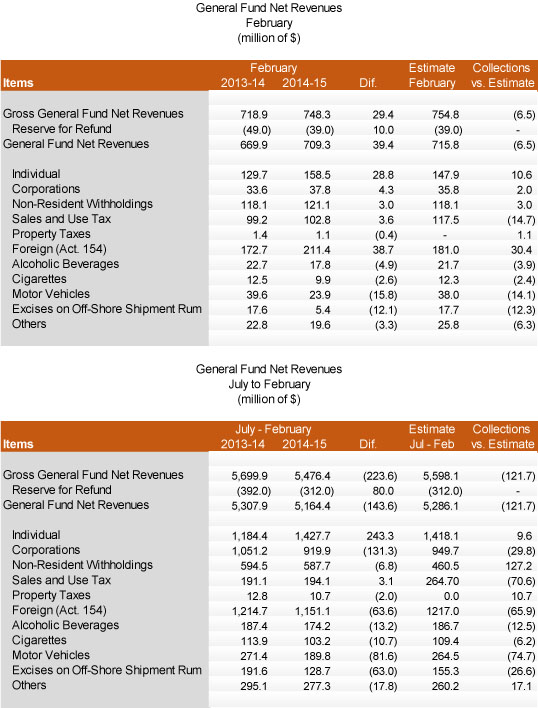

The Puerto Rico Treasury Department collected $709.3 million in February for the General Fund, a figure that was up $39.4 million, or 5.9 percent when compared to the same month last year, and $6.5 million, or 0.9 percent, below estimates.

Saying that it "is a serious attempt to carry out a comprehensive change of the tax system,” the Center for a New Economy suggested during public hearings Wednesday that the reform should be put off until Puerto Rico’s adverse fiscal conditions improve.

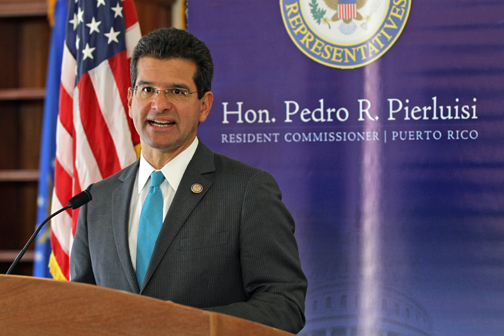

Resident Commissioner Pedro Pierluisi re-introduced legislation Tuesday to make hospitals in Puerto Rico eligible to receive bonus payments under Medicare for becoming users of electronic health records, or e-records.

The U.S. House Judiciary Committee’s Subcommittee on Regulatory Reform, Commercial and Antitrust Law held a hearing Thursday on H.R. 870, known as the “Puerto Rico Chapter 9 Uniformity Act of 2015,” which drew a bi-partisan delegation from the island to express support for inclusion.

The Puerto Rico Planning Board informed that at the end of 2014 it had approved 52 location consultations, representing a future investment of $3 billion and the potential to create 25,000 jobs.

A subcommittee of the House Judiciary Committee announced Thursday it will hold a hearing on House Resolution 870, known as the Puerto Rico Chapter 9 Uniformity Act of 2015, at 11:30 a.m. on Feb. 26th in Washington D.C.

House Speaker Jaime Perelló told Treasury Department officials during a hearing Wednesday that they need to “go back to the table” on certain aspects of the proposed tax reform, including the frequency with which consumers will receive rebates to mitigate the impact of the new 16 percent value-added tax structure.

Gov. Alejandro García-Padilla announced Wednesday the restructuring of the Puerto Rico Treasury Department, as well as offered details of the administration’s proposed tax reform expounded in a 1,400-page bill submitted at the Legislature late in the day.

Puerto Rico Gov. Alejandro García-Padilla offered a televised speech Tuesday in which he outlined his proposal for overhauling the island’s current tax system to what he described as a “simpler and fair one.”

The Economic Development Bank for Puerto Rico recently unveiled two new financing options for local and federal government contractors, with the goal of promoting procurement, agency President Joey Cancel said.

The tax overhaul currently being discussed at the highest levels of government, based on an analysis by KPMG Accounting Services, would shore up as much as $6 billion a year for the public coffers, based on the application of a new 16 percent goods and services tax, according to the report released Wednesday.

Saying the Commonwealth failed to justify its reasons for not doing so, the San Juan Superior Court on Tuesday ordered the Puerto Rico Treasury Department to make public the report produced by KPMG Accounting Services that is being used to shape the upcoming tax reform.

The Local Redevelopment Authority for the former Roosevelt Roads Naval Base in Ceiba and Clark Realty Capital on Monday signed the agreement that marks the beginning of negotiations leading to the eventual adoption of the "Master Developer" contract, scheduled for June 30, government officials announced Monday.

NIMB ON SOCIAL MEDIA