ETI: Housing affordability crisis persists in Puerto Rico

Puerto Rico’s housing affordability crisis remains unresolved, even as home prices posted modest declines in the first quarter of 2025, according to the Housing Affordability Index prepared by Estudios Técnicos Inc.

The index, which measures a typical family’s ability to qualify for a mortgage with a 20% down payment, rose to 56% from 53% in the fourth quarter of 2024. While slightly improved, the figure is far below the pre-pandemic historical average of 84%.

“Even with lower prices, housing remains out of reach for a large portion of the population,” said Leslie Adames, director of economic analysis and policy at Estudios Técnicos.

A score of 100% indicates that a family earns enough to qualify for a mortgage at the average home price. The index shows that affordability remains a major barrier for many Puerto Ricans.

According to the Puerto Rico Office of the Commissioner of Financial Institutions, the average price of a new home fell 19% year over year, to $286,234 in the first quarter of 2025 from $353,681 a year earlier. Existing-home prices fell just 3%, to $209,284 from $215,973.

Mortgage rates offered little relief. The average 30-year mortgage rate was 6.82% in the first quarter, compared with 6.73% at the end of 2024 and 6.75% a year earlier.

“To illustrate the impact on consumers, a person with an average annual income of $32,091 (equivalent to $2,674 per month) would face monthly payments of approximately $1,490 for a new home (56% of income) or $1,090 for a used home (41% of income),” Adames said.

“Both scenarios far exceed the recommended threshold of 30% to 35% of income for a mortgage. These calculations, which only include principal and interest, measure the magnitude of the problem: Housing costs continue to be out of reach for most buyers,” he added.

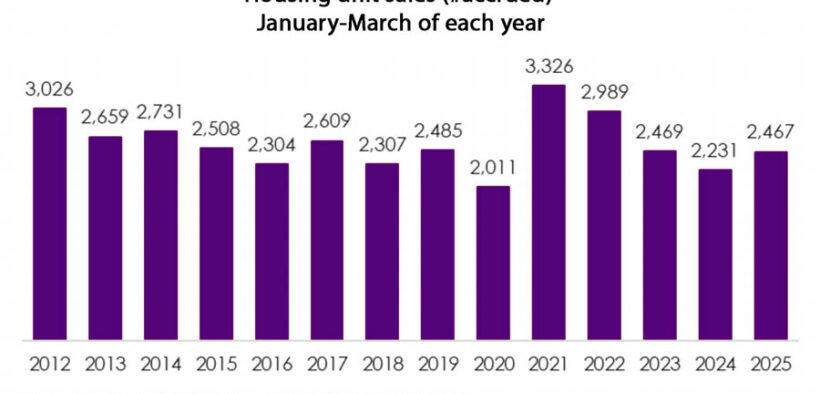

One bright spot in the market was a rebound in sales. In the first quarter, 2,467 housing units were sold, up 236 from the same period in 2024, the best first-quarter result in four years. The growth was concentrated in new units, with sales rising to 579 from 148. Existing-home sales fell to 1,888 from 2,083.

Adames said declining prices and government incentives are necessary but insufficient to address the affordability crisis. High construction costs, driven by rising materials prices and tariffs on aluminum and steel, remain a major obstacle. Labor shortages, worsened by immigration restrictions, and high borrowing costs linked to long-term interest rates compound the problem.

“None of these factors point to a return to normal in the short term,” Adames said. “The situation is worsened by internal consumer factors, including household budgets that remain under pressure and rising personal debt, which further limits the ability to qualify for housing.”

According to the U.S. Census Bureau’s 2024 American Community Survey, Puerto Rico’s homeownership rate is 69.3%, with about 1,616,963 housing units on the island.