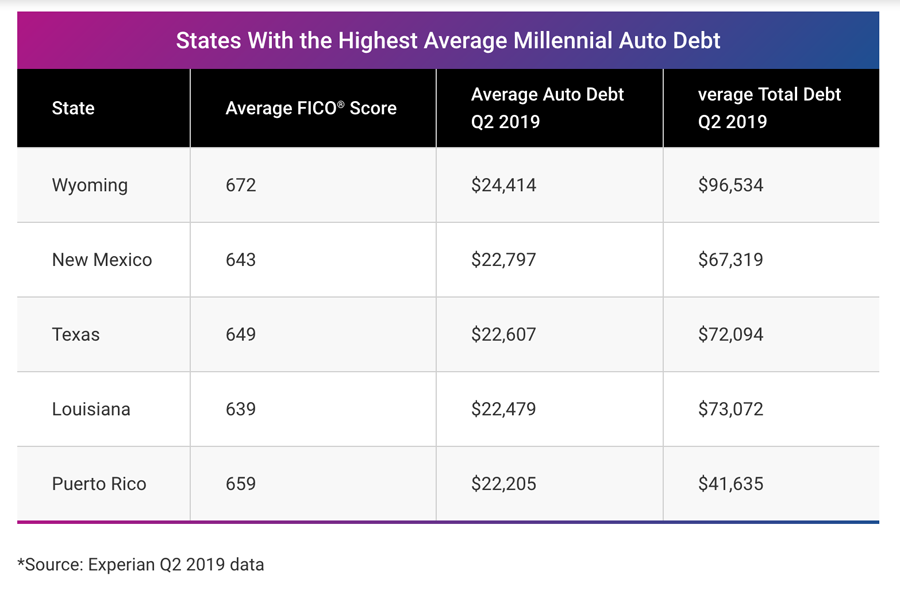

Experian: P.R. millennials have 5th highest auto loan debt among U.S., jurisdictions

Puerto Rico millennials — people between the ages of 23 and 38 — have the 5th highest average auto loan debt among all U.S. jurisdictions at $22,205, according to a new study by Experian.

“While millennials’ auto debt is the fastest-growing of any generation, they still owe less on their auto loans than the national average,” according a blog entry by Stefan Lembo Stolba, a data journalist on the content team at Experian Consumer Services, a division of Experian, the nation’s largest credit bureau.

“Millennials — consumers between ages 23 and 38 — carry an average auto loan balance of $18,201,” according to Experian data from the second quarter of 2019.

Puerto Rico’s millennials are fifth behind Wyoming, New Mexico, Texas and Louisiana in terms average auto loan debt.

Millennials have an average auto loan balance of $18,201 according to Experian data from the second quarter of 2019. That is 5% lower than the national average of $19,231, but 22% more than Generation Z’s average, who have the lowest average among generations at $14,272.

Millennials in general carry the third highest average auto loan debt among the generations — behind Generation X and Baby Boomers, Experian’s data confirmed.

The largest increase in auto loan debt since 2012 was seen by millennials at an average balance growth of 28%. At 3% growth since the second quarter of 2018, millennials are second in largest year-over-year jump in auto loan debt behind Generation Z at 5%.

As millennials age, their debt is increasing across all other debt products such as student loans, credit cards, and mortgage debt, Experian said.

I am not surprised about the average auto debt being so high in PR.

This is due to excessive excise taxes (arbitrios) that go back over 50 years and now dealers are charging amounts over list prices. Many dealers are charging $5,000 and more over the list price. It’s so bad that the cars in their showrooms have to show two disclosure statements to comply with government requirements.