Puerto Rico nears deadline on Opportunity Zone changes

The recently enacted One Big Beautiful Bill Act has permanently extended the federal Opportunity Zone program, adding reforms meant to modernize the initiative, expand community impact and reshape investment strategy — particularly in Puerto Rico.

The law makes the program a permanent part of the U.S. tax code and requires new compliance, reporting and impact measures. It also mandates a nationwide redesignation of eligible census tracts by mid-2026. Without those changes, investments made after Dec. 31, 2026, would have lost eligibility for key tax benefits.

The program, originally created as a short-term tax deferral mechanism, is shifting to a permanent framework. The law preserves the 10-year capital gains exclusion for investments held through Qualified Opportunity Funds but phases out older incentives.

One of the most significant changes is the federally required redesignation of all census tracts in 2026. That process is expected to reduce the number of eligible tracts, concentrating investment on areas that show clear economic need and readiness for development.

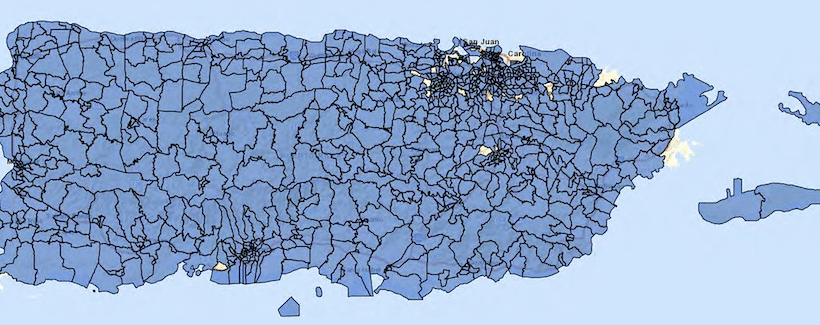

Puerto Rico, where nearly 98% of the island is designated as an Opportunity Zone, offers investors a limited window to combine those benefits with local tax incentives under Act 60, Puerto Rico’s 2019 Incentives Code. The law consolidated earlier incentive programs and provides tax breaks for investors and businesses that relocate or operate from the island. Benefits include reduced corporate tax rates, up to 40% in tax credits and large cuts in municipal and property taxes.

José Torres-Monllor, founder and managing partner at Monllor Capital Partners, shared with News is my Business a newly released report titled “What to Know Before the 2026 Deadline: Why Puerto Rico is the Smartest Move.” The report outlines current rules, upcoming changes and strategies for maximizing returns in Puerto Rico.

“The Opportunity Zone program is entering a pivotal moment,” the report said. “Federal redesignation is set to shrink the map of eligible census tracts, and the original capital gains deferral window closes at the end of 2026. Nowhere is the opportunity more compelling to act now than in Puerto Rico.”

Investors with realized capital gains or upcoming liquidity events are being urged to move quickly. Investments made before the end of 2026 will still qualify for deferral and will keep eligibility even if the tract loses its designation in the redesignation. That deadline is expected to accelerate investment in real estate, tourism and infrastructure projects with long development timelines.

After 2026, the program will enter what many are calling its “2.0 phase.” The window for deferring existing gains will close, but the most valuable benefit — excluding gains after 10 years — will remain. The new framework introduces stricter expectations for funds and investors to show measurable community results, local partnerships and full regulatory compliance.

The redesignation is likely to make the program more selective, with fewer tracts and greater competition for qualifying projects. In Puerto Rico, that could shrink coverage in developed or higher-income areas. Many investors are expected “to move quickly to lock in projects under the current map.”

Torres-Monllor said that while the program is evolving, its underlying value is intact. The emphasis on long-term appreciation and impact-focused investment, he said, creates opportunities for those willing to work closely with local communities. Rural zones and federally designated Priority Projects may become more attractive, especially when paired with Puerto Rico’s additional incentives.

Monllor Capital said it is advising investors to recalibrate their strategies rather than pull back.