Puerto Rico stocks up 15% as investors bet on financial, fintech strength

Despite six consecutive months of decline in Puerto Rico’s Economic Activity Index (EAI), the island’s financial markets are showing unexpected strength, with the Birling Capital Puerto Rico Stock Index up 15.06% year-to-date as of June.

The divergence between investor sentiment and real economic indicators highlights growing confidence in corporate performance, especially in banking and fintech, according to Birling Capital’s June 2025 Monthly Market Review, authored by President and CEO Francisco Rodríguez-Castro.

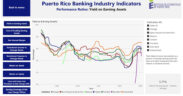

Popular, Inc. led the index with a 21.45% return, supported by a 6.1% year-over-year revenue increase and strong earnings. First Bancorp followed with a 17.86% gain, buoyed by higher profitability and technical momentum. OFG Bancorp posted a 6.31% increase, while Evertec rose 8.66% on continued digital infrastructure growth and Latin America expansion.

These gains come despite ongoing macroeconomic weakness. The EAI declined 0.9% in February, and sectors such as construction and public employment remain soft. Unemployment stood at 5.5% in May, offering some labor market stability.

“Despite shrinking GDP, investors are betting on corporate earnings — especially in finance and fintech,” the report states. “The rally reflects market belief in Puerto Rico’s economic turnaround.”

Banks are expanding commercial mortgage and consumer credit portfolios, while Evertec pursues acquisitions aimed at regional growth.

Still, Birling warned of a potential disconnect between stock gains and broader conditions.

“While equities soar, underlying economic activity remains in contraction,” the report cautioned.

Forecasts vary: the Puerto Rico Planning Board projects 1.1% GDP growth in 2025, while the Financial Oversight and Management Board expects a 0.8% contraction.

The report notes that tax incentives, capital flow initiatives, and infrastructure projects could help bridge the gap between market performance and economic fundamentals in the second half of the year.

Investor confidence remains focused on resilient corporate balance sheets, steady earnings growth and fintech innovation — trends that suggest hope for a private sector-led recovery.