Puerto Rico’s aging population spurs shift in business, marketing focus

People are living longer, prompting business and marketers to rethink their strategies to reach and cater to older adults.

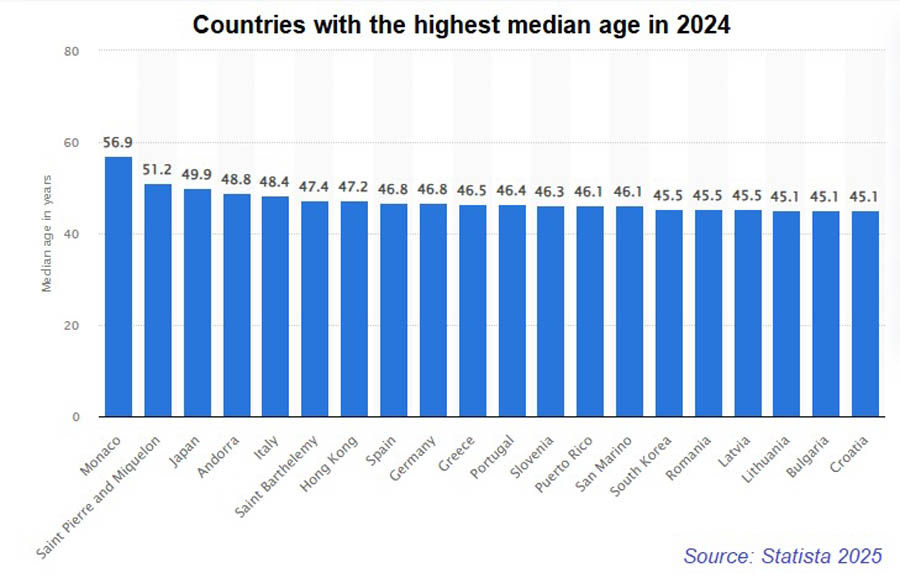

With a median age of 46.1, Puerto Rico has the 13th highest median age in the world, according to data from Statista. The U.S. Census Bureau puts Puerto Rico’s median age at 45.6, up 0.3 years from 2023 and 1.8 years from 2020.

In 2024, 18- to 64-year-olds accounted for 60.4% of Puerto Rico’s population, with adults over the age of 65 representing 24.6% of the population, according to the Vintage 2024 Population Estimates released in June by the U.S. Census Bureau. Older adults outnumbered children in Puerto Rico by more than 300,000 in 2024, up from 151,000 in 2020.

The number of people aged 65 and older in the U.S. rose by 3.1% to 61.2 million last year, while the population under age 18 decreased by 0.2% to 73.1 million from 2023 to 2024, the U.S. Census Bureau reported. From 2004 to 2024, the share of the population aged 65 and older steadily rose from 12.4% in 2004 to 18% in 2024, while the share of children declined from 25% to 21.5%.

An aging world

An aging population is a worldwide trend. By 2030, one in six people in the world will be aged 60 years or older, increasing from 1 billion in 2020 to 1.4 billion, the World Health Organization recently reported. By 2050, the world’s population of people aged 60 years and older will double to 2.1 billion, and the number of people aged 80 years or older will triple between 2020 and 2050 to reach 426 million, the WHO said.

By 2080, people aged 65 and over will outnumber children under 18, according to the United Nation’s World Population Prospects 2024 report. By the mid-2030s, there will be 265 million individuals aged 80 and older, outnumbering infants, the UN reported, indicating that even rapidly growing nations will experience a rise in the elderly population over the next 30 years.

What it means to businesses and marketers

A higher median age in a market significantly impacts businesses by shifting consumer preferences, altering labor market dynamics and creating new opportunities in sectors catering to the needs of an older population, according to multiple studies and reports.

As a result, businesses and marketers need to adapt their product development and marketing strategies to reach older consumers, focusing on channels they use and developing products and services that meet their specific needs, preferences and values.

An older population typically boosts demand for health care and related services, such as geriatric specialists, home health care, assisted living facilities, medical devices and pharmaceuticals, and growth in the silver economy, fueling businesses that cater to leisure, travel and financial services designed for retirees or those approaching retirement.

Consumer preferences also change with age. Older consumers tend to prioritize reliability, ease of use and familiarity over novelty and brand innovation. Although some older consumers buy fewer items per visit to stores, they are often willing to pay more for products that meet their specific needs.

In marketing, websites increasingly will need larger fonts, intuitive navigation and voice-assist features. Packaging and store layouts must consider usability for all ages. Brands should be aware that seniors value clear information, straightforward claims and brand ethos, especially on quality and ingredient integrity.

Seniors’ desire to “age in place” leads to higher demand for homes with accessible features, as well as retirement communities and assisted living facilities. Older adults usually prefer smaller, low-maintenance homes or apartments, which may affect demand for larger family homes.

Companies offering flexible work arrangements and retraining programs for older workers may thrive as more older adults choose to remain in the workforce or pursue new careers during their retirement years.

As the population ages, tech companies will have to shift some of their focus from younger audiences to older adults and develop user-friendly devices, telehealth solutions and smart home systems to promote independent living and enhance quality of life.

Investors take notice

A higher median age can be an investment opportunity, Morgan Stanley said in its recent report “Age of Aging: Opportunities in Longevity and Generational Shifts.” Older adults now control three-quarters of all wealth in the U.S., giving them an outsized influence on consumer spending, the firm reported.

“Investors can find long-term opportunities in sectors that cater to older adults, such as independent living, senior housing, the gig economy and wealth management,” Morgan Stanley said, noting that companies that cater to older consumers, whether helping people age in place or managing the largest wealth transfer in history, are poised for long-term growth.

The aging global population will have significant implications for investors not just for the coming years but for the coming decades as long-term demographic trends play out, according to Fiduciary Trust, which advises investors to seek funds centered on health care, biotech, real estate, insurance, financial services and tourism.

“These demographic shifts won’t merely affect specific industries, they could also influence allocation decisions across regions and countries while resetting expectations for overall economic growth,” the Boston-based firm reported.