Puerto Rico’s economy shows signs of slowdown in June

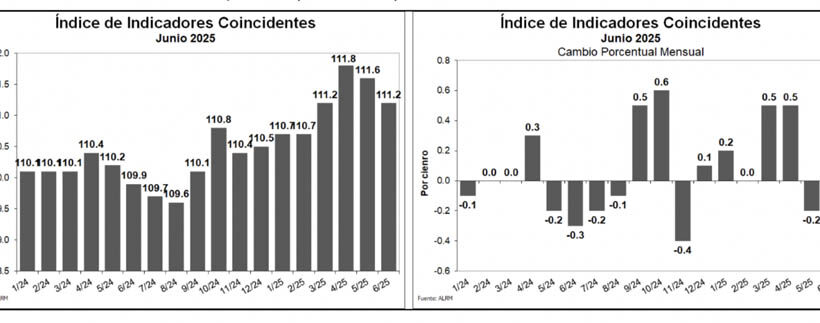

Puerto Rico’s economy showed a modest deceleration in June, as the Composite Coincident Index fell for the second straight month to 111.2 points, a 0.4% decline from May.

The slowdown followed stronger activity in early spring, when consumer spending was lifted by Mother’s Day sales and end-of-school events.

Despite the monthly contraction, economic activity in June was 1.2% higher than a year earlier, underscoring resilience amid inflation and global uncertainty, according to an analysis by economist Ángel Rivera-Montañez.

The June results capped fiscal year 2025 with a 0.8% rise in economic activity, down from the prior year’s 3% growth rate. It marked the fifth consecutive fiscal year of expansion — not seen since the 1980s and 1990s, when the island averaged 3% growth. For the current cycle, average growth stands at 2.8%.

The labor market softened slightly in June, while consumer spending retreated from May’s spike. Industrial and construction activity improved, partly offsetting weaker household demand.

The labor market softened slightly in June, while consumer spending retreated from May’s spike. Industrial and construction activity improved, partly offsetting weaker household demand.

The Leading Indicators Index, meanwhile, offered a more optimistic signal. It rose 0.4% from May and 2.3% year over year, its eighth straight annual increase after 32 consecutive months of declines. The LII’s Diffusion Index hit 77.4 points, suggesting broad-based growth.

The Composite Coincident Index Diffusion Index also read 60.5, above the 50-point threshold for the fourth month in a row, pointing to stable footing and easing recessionary pressures.

Still, risks remain. Rivera-Montañez warned of potential price increases that could weaken consumption, slower government spending, reduced investment and higher business costs.

He cited two main risks: the final resolution of the Puerto Rico Electric Power Authority’s debt, which could drive energy costs higher, and reduced federal reconstruction funds under new fiscal policies. Both, he said, could trigger lasting shocks.

Rivera-Montañez stressed the importance of the indices in monitoring economic cycles.

“The CII has been effective in measuring and determining the different phases of Puerto Rico’s economic cycles,” he said. “The LII has been effective in measuring changes in activity before such events occur, at the entrance and exit of the cycles experienced since the 1970s.”

Forecasts for the second half of 2025 point to slower growth and potentially higher prices. But gains in leading indicators reduce the likelihood of a deep recession, leaving policymakers and businesses cautiously optimistic.