The current Financial Oversight and Management Board for Puerto Rico is attempting to invalidate more than $6 billion of general obligation bonds and to initiate clawbacks of principal and interest payments to bondholders. It claims that the bonds were issued in excess of a Puerto Rico constitutional debt limit, notwithstanding the Commonwealth’s specific representations to […]

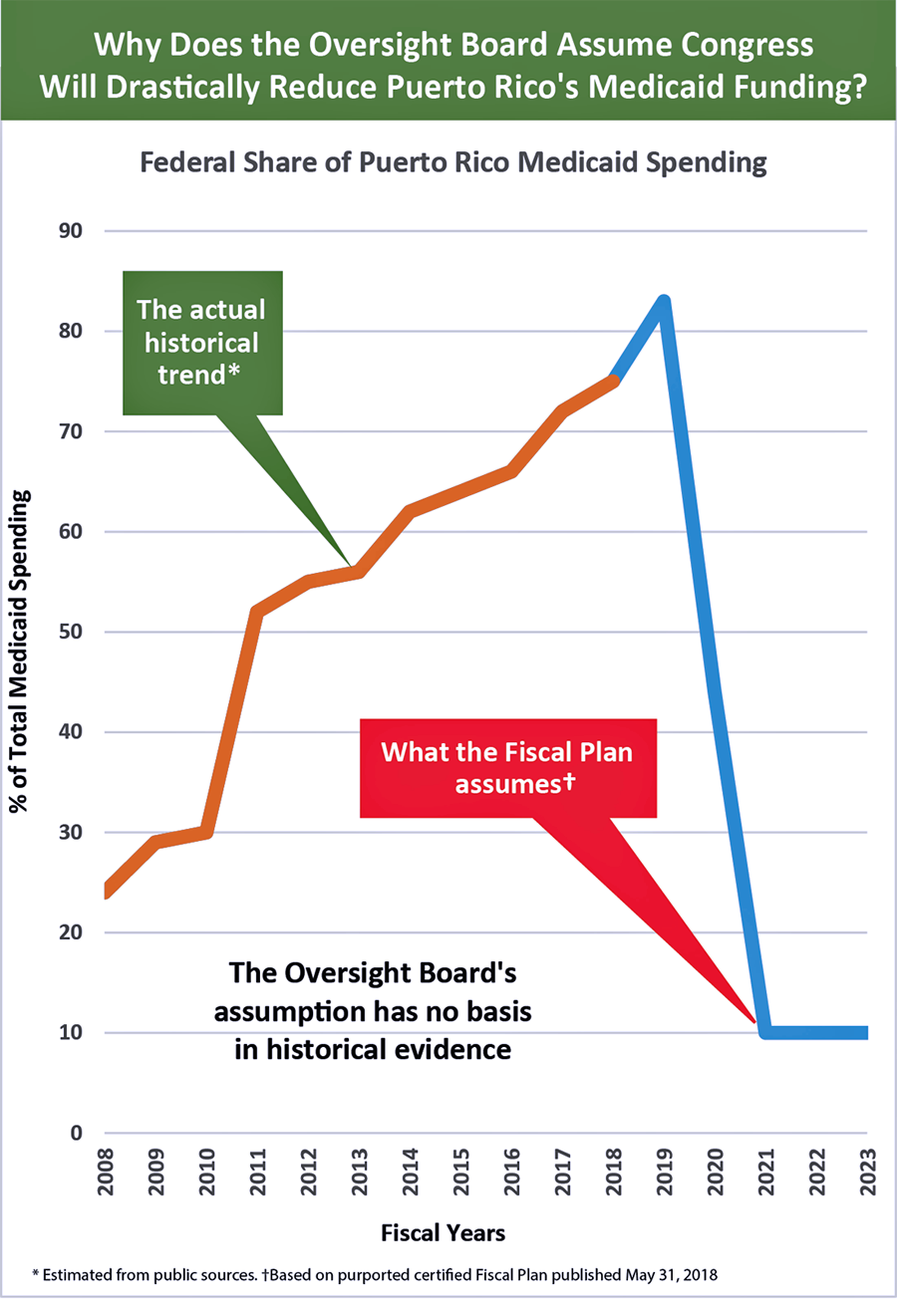

This in turn will fall short of leading Puerto Rico “toward a more sustainable economic future,” the company stated.

Two bond insurance subsidiaries of Assured Guaranty Ltd. have filed an adversary complaint challenging the constitutionality of appointments to the Financial Oversight and Management Board for Puerto Rico.

Puerto Rico had greater financial resources than it previously claimed, but there continues to be little transparency in the process, and audited financial statements still have not been produced since 2014, said Dominic Frederico, CEO of Assured Guaranty Ltd., which holds government debt.

Reactions from the public and private sector poured in Thursday on the Revised Fiscal Plans for the government of Puerto Rico, the Puerto Rico Electric Power Authority and the Puerto Rico Aqueduct and Sewer Authority presented to the Financial Oversight and Management Board for Puerto Rico for certification.

Assured Guaranty, a monoline insurer for Puerto Rico Electric Power Authority debt, reacted to the administration’s announced plans to privatize the utility by saying agreeing on an “on an experienced, highly qualified manager able to impose order, transparency and accountability” is long overdue.

Assured Guaranty Ltd. Filed an adversary complaint challenging the Commonwealth of Puerto Rico’s “illegal diversion” of special revenue bond collateral that secures the payment of Puerto Rico Highways and Transportation Authority bonds.

Two bond insurance subsidiaries of Assured Guaranty Ltd. have made some $205 million in debt service payments to holders of insured General Obligation and other bonds on which Puerto Rico and certain of its entities defaulted on July 1, the company announced Thursday.

NIMB ON SOCIAL MEDIA