Volaris, the ultra low cost Mexican airline servicing Mexico and the United States, announced Tuesday the introduction of new international service between Cancún and San Juan, starting July 2nd.

Fulfilling its social responsibility goals, Banco Popular recently became the first bank to invest in the Community Investment Fund run by the Puerto Rico Community Foundation, investing $250,000.

The arresting leaf coverage on the exterior walls of the Banco Popular Foundation's newly inaugurated headquarters in Hato Rey offers the most recent public evidence of the green building revolution that is slowly but progressively taking hold in Puerto Rico.

Following weeks and months of speculation about its fate, the Puerto Rico Office of the Commissioner of Financial Institutions and the Federal Deposit Insurance Corporation, announced Friday the closing of Doral Bank’s local and stateside operations.

Puerto Rico’s commercial banks will be observing today’s Martin Luther King holiday with special hours, scheduled as follows:

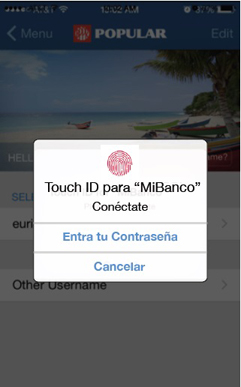

Banco Popular announced Tuesday the launch of a new feature in its mobile banking system that allows customers to access their accounts using their fingerprint.

Popular Inc. announced Tuesday its banking subsidiary, Banco Popular de Puerto Rico, received the prestigious “Bank of the Year Puerto Rico for 2014” award from The Banker, an international banking magazine published by The Financial Times.

The economic situation that has enveloped the island in recent years has a direct impact on the lives of thousands of Puerto Ricans. Among the various consequences this situation can generate is that many families have trouble making payments on their debts, including mortgages.

Popular Inc., parent company of Banco Popular de Puerto Rico, saw its net income increase by 144 percent year over year to $599.3 million for the year ended December 2013, in comparison to the $245.2 million reported for the prior 12-month period.

Puerto Rico’s declining population, rapidly aging workforce, significant fiscal pressures and subsequent policy measures have combined to prompt a reduction in the government’s workforce over the past five years by as many as 55,000 jobs, or almost 20 percent of the public sector’s workforce.

Thousands of Banco Popular employees and their families donated their time Saturday to participate in the “Make a Difference Day,” to support nearly 100 community projects in Puerto Rico, the U.S. Virgin Islands and the U.S. mainland.

A group of private sector representatives, headed by Banco Popular de Puerto Rico, is banding together to come up with a strategy to encourage a general change in attitude, place education as the epicenter of that change, and develop the business sector as an emerging paradigm for the island.

Uncertainty over the impact of new taxes on businesses may be putting a break on entrepreneurship with Puerto Rico's largest bank reporting a slowdown in its small business loan activity.

In an effort to educate young people about how to establish and make proper use of credit, Banco Popular de Puerto Rico, in partnership with the American Bankers' Association, will sponsor the “Get smart about credit” event this month.

A year after launching “Depósito Fácil” (“Easy Deposit”), a service that allows Banco Popular clients to deposit checks without having to use an envelope or fill out a deposit slip, the financial institution announced Tuesday it will be expanding the number of ATMs enabled to accept those transactions from 10 to 50 by the end of September.

NIMB ON SOCIAL MEDIA