Tampa-based Mark A. Tepper securities law firm announced Monday it is investigating alleged claims against brokers and financial advisors for recommending Puerto Rico General Obligations (GO) and/or Puerto Rico municipal bonds.

Puerto Rico Acting Gov. Víctor Suárez, signed House Bill 2864 into law Wednesday, creating the Puerto Rico Aqueduct and Sewer Authority Revitalization Act, a statute that gives the water utility the tools to access capital markets and achieve self-sustainability.

Two bond insurance subsidiaries of Assured Guaranty Ltd. have made some $205 million in debt service payments to holders of insured General Obligation and other bonds on which Puerto Rico and certain of its entities defaulted on July 1, the company announced Thursday.

Due to the possibility of a government default on some $2 billion in debt service due July 1, Puerto Rico credit unions confirmed they have enough financial capacity to face the situation, with $486 million in reserves to face possible investment losses.

Moody’s Investors Service said Monday the new surcharge on customers’ electricity bills approved last week by the Puerto Rico Energy Commission to be used to pay debt service on new securitization bonds to be issued as part of the Puerto Rico Electric Power Authority’s debt restructuring is positive for creditors.

A yet undefined increase on water rates for residential and commercial customers could come as early as mid-July, if lawmakers are unable to move a bill authorizing financing mechanisms for the cash-strapped Puerto Rico Aqueduct and Sewer Authority, agency officials said Wednesday.

Following the Puerto Rico government’s confirmation Tuesday that negotiations with Rico Sales Tax Financing Corporation (known as COFINA) and General Obligation bondholders had broken off, both creditor groups went public to defend their positions on the ongoing talks.

An independent commission established by Puerto Rico's government has issued a report casting doubt on the legality of the island's debt, which could be declared null by a court if it decides the Commonwealth borrowed without authorization.

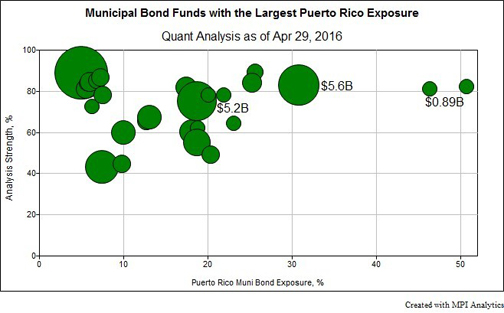

As many as 29 out of 562 U.S. municipal bond funds currently carry an exposure to Puerto Rican bonds greater than 5 percent, some with an estimated exposure approaching 50 percent.

The Center for Investigative Journalism (CPI, as it is known for its initials in Spanish) scored a legal victory in its fight against the government for access to information on the identity of Puerto Rico’s bondholders.

Members of the government’s Working Group for the Fiscal and Economic Recovery of Puerto will release today details of a revised voluntary exchange proposal presented to advisors to the Commonwealth’s creditors in March.

The Puerto Rico Electric Power Authority announced Tuesday it has extended its contract with AlixPartners through Aug. 15, 2016, as the utility seeks to implement its ongoing comprehensive financial restructuring and operational transformation.

Small businesses will have more contracting opportunities beginning in Fiscal 2017 thanks to a law President Obama signed recently that increases the maximum Small Business Administration surety bond guarantee percentage by 20 percent.

Moody’s Investors Service on Wednesday released a report in which it predicted that Puerto Rico is “likely to default” on some of its debt service payments due in December, as “its liquidity pressure grows.”

Government Development Bank President Melba Acosta said Tuesday the administration “has faith” it will pull Puerto Rico out of the fiscal abyss it is currently in, and will set up mechanism to avoid a repeat of the island’s current $73 billion debt scenario.

NIMB ON SOCIAL MEDIA