Most manufacturing in Puerto Rico is done by subsidiaries of companies based in the States organized in foreign tax havens to avoid Commonwealth as well as federal taxes. Income of the subsidiaries is not federally taxed unless transferred to the parent company, when it would then owe the 35 percent corporate income tax rate.

The Puerto Rico Senate approved late Monday the Teacher's Pension System reform bill submitted by Gov. Alejandro García-Padilla last week. The Senate's approval follows Saturday night's passage by the House of Representatives. The bill now goes to the governor's desk to be signed into law.

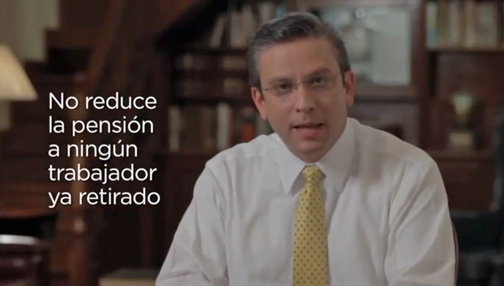

Amid outcry from many public workers who will see their pension benefits dwindle once they retire from their government jobs, Puerto Rican lawmakers approved and Gov. Alejandro García-Padilla signed a sweeping reform aimed at “rescuing” Commonwealth’s Employees Retirement System.