Credit ratings agency Moody’s Investor Service issued a report Wednesday saying that Commonwealth employee retirement system (ERS, for short) reform and the projected changes to the sales and use tax system are both positives for the island’s credit, despite the ongoing fiscal indebtedness.

Fitch Ratings officials said Monday the pension reforms that the Puerto Rican government has enacted are “positive and an important step toward achieving credit stability.”

Amid outcry from many public workers who will see their pension benefits dwindle once they retire from their government jobs, Puerto Rican lawmakers approved and Gov. Alejandro García-Padilla signed a sweeping reform aimed at “rescuing” Commonwealth’s Employees Retirement System.

Puerto Rico’s executive branch has the necessary staff, resources and commitment to take over managing and resolving the island’s fiscal issues and block out all of the “noise” coming out of the Legislature, veteran Economist José Joaquín Villamil recently said.

The Individual Retirement Account, best known as an IRA, is one of the few options that the Puerto Rico Internal Revenue Code provides as a tax shelter mechanism for tax relief when filing the income tax return. In addition, the IRA promotes the creation of a private and individual fund for the account holder’s eventual retirement.

The proposed amendments to the main public sector retirement system are as decisive as the crisis requires. However, the distribution of the burden is inappropriate because they represent little sacrifice on the part of the pensioners and a lot of sacrifice on the part of Puerto Rico's younger population.

Shooting down reports circulated Tuesday saying it planned to close its Guayama operation, pharmaceutical company Lilly del Caribe announced and launched a voluntary severance program for eligible employees working at the site.

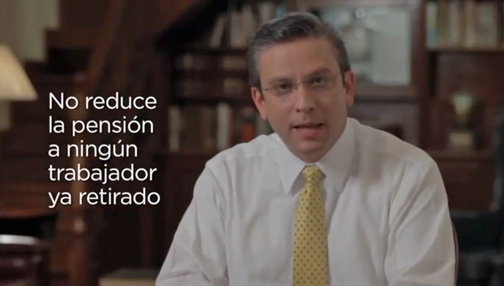

Gov. Luis Fortuño’s administration has three months to show Moody’s Investors Service that it is taking enough — and correct — action to address the Commonwealth Retirement System’s $28 billion funding shortfall to avoid a possible downgrade of its current A3 rating.

NIMB ON SOCIAL MEDIA