Treasury Secretary Teresita Fuentes confirmed that the agency’s Administrative Determination No. 17-19 regarding the non-applicability of the Sales and Use Tax (SUT) to certain donations continues in force.

Sales Tax Financing Corp. bondholders submitted an Agreement in Principle in the U.S. District Court in Puerto Rico, potentially ending its dispute with the island’s government.

Puerto Rico Gov. Ricardo Rosselló signed several executive orders to boost the economy, including one that exempts small and medium enterprises from collecting Sales and Use Tax on the sale and purchase of inventory.

Net revenues recorded to the General Fund totaled $708.8 million in May, with fiscal year-to-date (July-May) revenues reaching $8.3 billion, Treasury Secretary Raúl Maldonado Gautier said Tuesday.

The switch-over from a B2B IVU to a B2B IVA should not raise consumer prices nor costs to business, according to Economist Vicente Feliciano, president of Advantage Business Consulting.

Since going into effect last October, the Sales & Use Tax (SUT) on business-to-business (B2B) services has generated $26.4 million, the Puerto Rico Treasury Department reported.

The Puerto Rico Treasury Department is prepared to handle the change rate of the Sales and Use Tax to 11.5 percent, from the current 7 percent, when it goes into effect July 1, agency Secretary Juan Zaragoza said Tuesday.

Puerto Rico Gov. Alejandro García-Padilla offered a televised speech Tuesday in which he outlined his proposal for overhauling the island’s current tax system to what he described as a “simpler and fair one.”

Last month's Sales and Use Tax revenue, which includes transactions made in August, totaled $124.2 million, the highest level for a month of September since the SUT was implemented in November 2006, the Treasury Department said Wednesday.

The Puerto Rico Treasury Department reported Thursday preliminary revenue for July 2014, the first month of the current fiscal year, reached $624 million, up $129 million, or 26 percent, from the total on record for the same month last year.

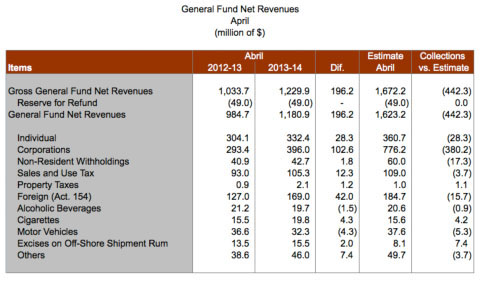

Puerto Rico’s revenue collections for the month of April fell significantly below estimates, short by $442.3 million at $1.18 billion, but up by $196 million year-over-year, the Treasury Department said in a release distributed after the end of business Friday.

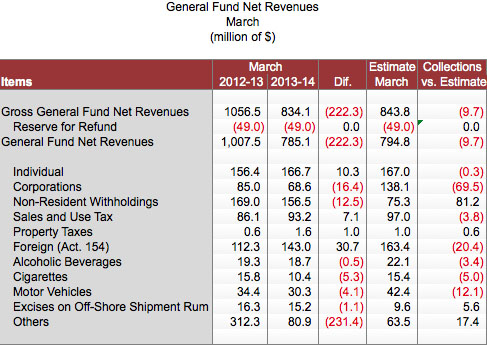

General Fund collections for the month of March totaled $785 million, down 9.7 percent when compared to the $1 billion on record for March 2013.

As part of the government’s strategies to increase tax evasion oversight, Puerto Rico Gov. Alejandro García-Padilla sent a bill to the Legislature that will allow the use of certified payment processors in all local businesses, as well as the exchange of information between municipalities and the Treasury Department.

Puerto Rico’s General Fund revenue collections for the month of January amounted to $664 million, a figure that is $1 million less than the same period last fiscal year, but that Treasury Secretary Melba Acosta described as a “record.”

NIMB ON SOCIAL MEDIA