The government of Puerto Rico will establish work groups comprising local and federal officials, as well as private-sector executives, to brainstorm on potential alternatives to offset the loss of federal credits granted for taxes paid by manufacturing companies under the Commonwealth’s Law 154. The tax credits, which will be phased out by the U.S. Department […]

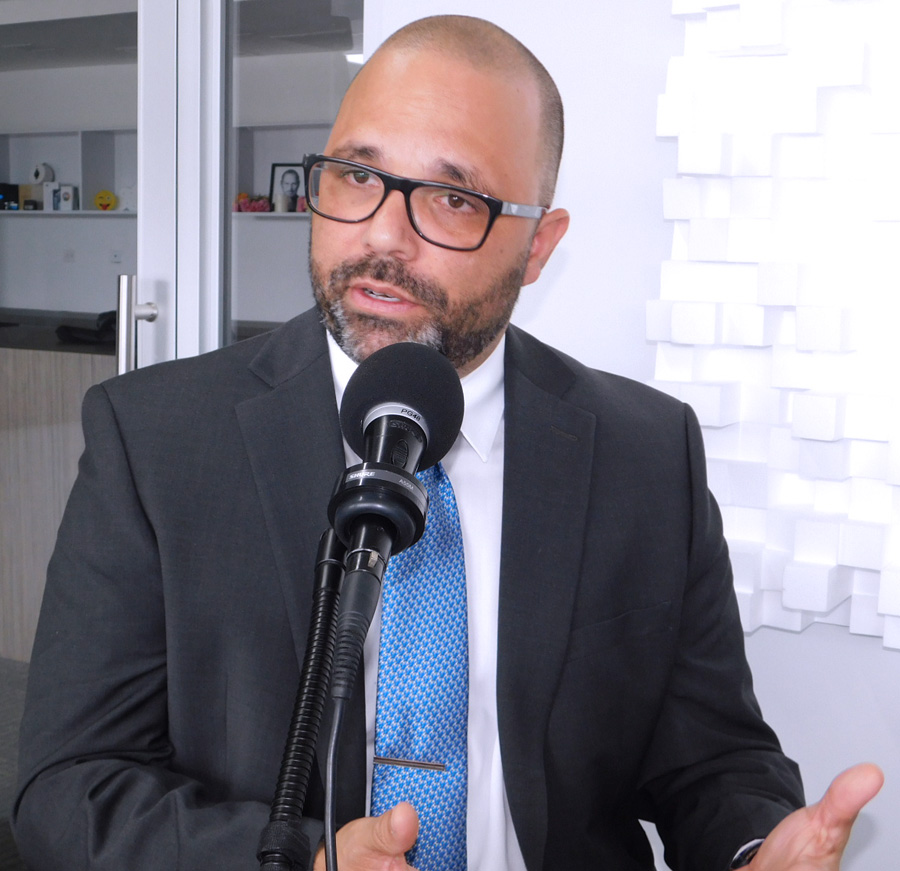

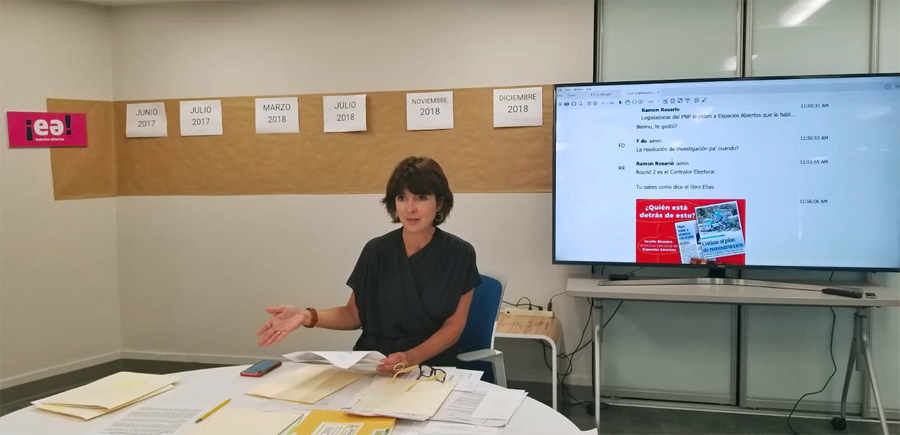

Nonprofit organization Open Spaces filed a motion before the Puerto Rico Supreme Court to overturn a decision by the Appellate Court to keep the government’s Report on Tax Reduction Agreements under seal. The report listing tax abatement agreements was prepared and delivered to the Financial Oversight and Management Board for Puerto Rico in July 2017. […]

An Earned Income Tax Credit, an issue that is taking center stage as part of the discussion of the Puerto Rico tax reform, “does justice to workers” and is “good public policy,” Cecille Blondet, director of nonprofit Espacios Abiertos, said. Upon unveiling a study it recently commissioned from Economist María E. Enchautegui, Espacios Abiertos believes […]