Meet Puerto Rico and key components of the island’s tourism industry expressed their support Monday of the House Bill 2867, which would establish a fixed daily surcharge of $3.50 on car rentals by non-residents.

The Commonwealth will appeal the decision by U.S. District Judge José A. Fusté invalidating the transfer pricing tax applied to Wal-Mart, Gov. Alejandro García-Padilla said Monday, while blasting the judge for “taking away $100 million” from the people of Puerto Rico.

Retail sales reported by Puerto Rico’s commercial establishments during the January to December 2015 period reflected a 1.42 percent year-over-year drop, with sales down by $544.7 million to $37.8 billion, Puerto Rico Trade and Export revealed Thursday.

The switch-over from a B2B IVU to a B2B IVA should not raise consumer prices nor costs to business, according to Economist Vicente Feliciano, president of Advantage Business Consulting.

On April 1, Puerto Rico will adopt a Value Added Tax (VAT) system and the island's advertising industry will fall in line with other business sectors in paying a tax for services from which it was temporarily exempted.

Since going into effect last October, the Sales & Use Tax (SUT) on business-to-business (B2B) services has generated $26.4 million, the Puerto Rico Treasury Department reported.

The Puerto Rico Government Development Bank (GDB) warned Gov. Alejandro García-Padilla that without an approved tax reform and a budget adjusted to public spending and the island’s fiscal reality, the government could run out of money and shut down within the next three months.

The strategy set forth by Gov. García-Padilla’s administration to try shore up liquidity for the Government Development Bank for Puerto Rico through the reliance on a recently approved oil tax hike may fall short if prices increase, or the island’s population continues to shrink, economist firm H. Calero Consulting exposed in its most recent monthly publication.

Several prominent Puerto Rican economists urged lawmakers on Monday to exempt educational institutions from the proposed 16 percent value-added tax being discussed as part of a sweeping tax reform for the island.

Tax Credits International Inc. announced Wednesday the establishment of its world headquarters in Humacao, on Puerto Rico’s eastern end.

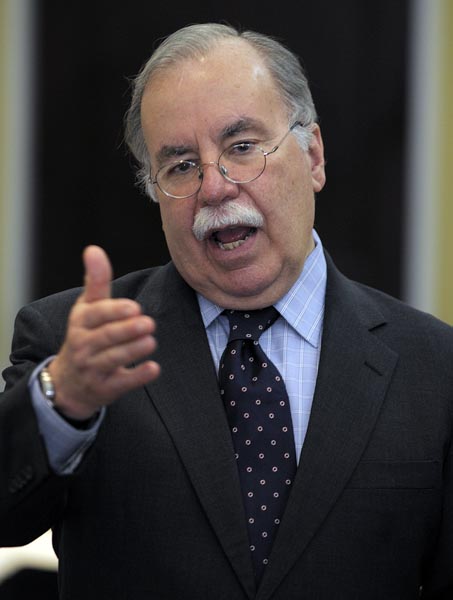

On the heels of its legal victory last week, Doral Financial Corp.’s Economic Advisor Robert Shapiro on Monday urged the government of Puerto Rico to honor the tax agreement upheld by a local court, “for the sake of its credibility.”

Last month's Sales and Use Tax revenue, which includes transactions made in August, totaled $124.2 million, the highest level for a month of September since the SUT was implemented in November 2006, the Treasury Department said Wednesday.

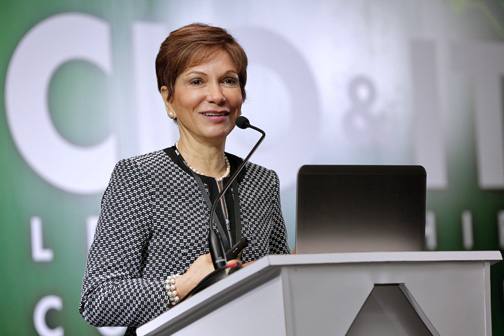

The Puerto Rico Treasury Department has spent the last seven months working with a team of local and international experts in tax, fiscal and economic matters to propose an overhaul to the island’s Internal Revenue Code that ultimately should eliminate the “uncertainty” associated with elements of the decades-old statute, agency Chief Melba Acosta told members of the media Thursday.

Despite word that court-ordered talks between the government and Doral Financial Corp. had broken down late Friday, representatives from both parties confirmed negotiations are still on the fate of a $229 million tax refund the bank is claiming from the government.

NIMB ON SOCIAL MEDIA