Puerto Rican managed care company Triple-S Management Corporation announced Thursday consolidated revenues of $744.7 million and a net loss of $1.9 million, or $(0.08) per diluted share, versus net income of $4.2 million, or $0.16 per diluted share a year ago.

Oriental Bank has implemented a number of strategies to expand its customer base and increase its market share of young people and women, achieving sustained growth for the past 18 months, company officials said Wednesday.

First BanCorp., the bank holding company for FirstBank Puerto Rico, reported Tuesday net income of $24.1 million for the third quarter of 2016.

Popular Inc. released earnings for the third quarter on Tuesday, reporting net income of $46.8 million for the three-month period ended Sept. 30, 2016, compared to net income of $89 million for the quarter ended June 30, 2016.

Oriental Bancorp reported $11.7 million in net income for the third quarter of 2016 ended Sept. 30.

In the wake of a 17.5 percent growth in ATM transactions during 2015, FirstBank announced Wednesday the expansion of its automatic teller network in Puerto Rico with a total of 80 new locations.

Banco Popular de Puerto Rico announced Tuesday that it lost an appeal before a review board deciding over a dispute with the Federal Deposit Insurance Corp., representing a $55 million hit for the bank.

OFG Bancorp announced Tuesday that its subsidiary Oriental Bank’s outstanding participation in a line of credit to the Puerto Rico Electric Power Authority (PREPA) has been sold, thereby significantly reducing its direct exposure to Puerto Rico government related credits.

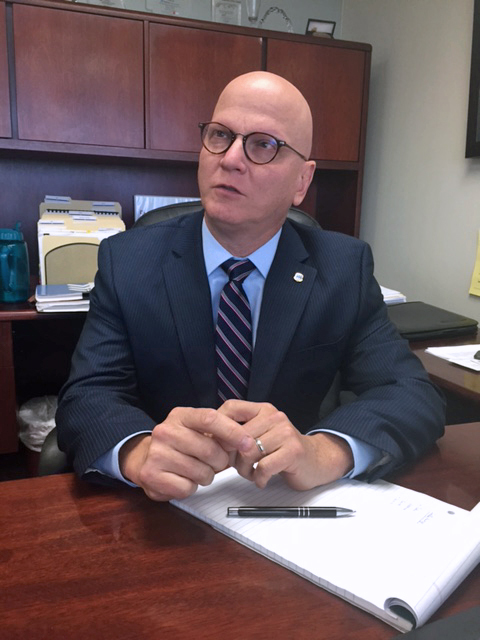

Puerto Rico’s banking sector, which has been weathering the island’s economic storm for the better part of the last decade, could benefit from the arrival of the Fiscal Control Board, and the trust it could instill on future investors, Financial Institutions Commissioner Rafael Blanco said.

Three of Puerto Rico’s main banks — Banco Santander Puerto Rico, Popular Inc. and FirstBank Puerto Rico — banks can absorb further asset quality stress resulting from Puerto Rico’s recession for at least two more years, Moody’s Investors Service said in a report released Thursday.

Popular Community Bank, a subsidiary of Popular Inc. announced Thursday the opening of a new retail branch in Aventura, Florida, the first high-tech branch unveiled in the area, bank officials said.

The Puerto Rico Bankers Association will be submitting a set of recommendations to the Congressional Task Force on Economic Growth addressing key areas in federal banking regulations that could be eased to benefit the Commonwealth’s economy, Executive Director Zoimé Álvarez-Rubio confirmed Wednesday.

First BanCorp, the bank holding company for FirstBank Puerto Rico, on Tuesday reported net income of $22 million for the second quarter of 2016, or $0.10 per diluted share, compared to $23.3 million, or $0.11 per diluted share, for the first quarter of 2016 and a net loss of $34.1 million, or $0.16 per diluted share, for the second quarter of 2015.

Popular Inc., parent company of Banco Popular, on Tuesday reported net income of $89 million for the quarter ended June 30, 2016, compared to net income of $85 million for the quarter ended March 31, 2016.

NIMB ON SOCIAL MEDIA