First BanCorp, the bank holding company for FirstBank Puerto Rico, announced late Wednesday that it will delist its preferred stock from the New York Stock Exchange, effective before the market opens Jan. 17.

QBE Insurance Group announced Wednesday it has agreed to acquire Optima Insurance Group, an underwriting group in Puerto Rico that posted an estimated $100 million in gross written premium in 2011. The financial terms of the deal were not revealed.

The continued deterioration of European credit has reached Puerto Rico’s insurance market, with the recent decision by reputed insurance industry rating agency, A.M. Best to place the ratings of MAPFRE PRAICO Group and its members under review with negative implications.

After suffering several years of substantial losses locally and stateside, Banco Popular has “solidified its capital base” and is “now poised to build upon its dominant position in Puerto Rico while returning its mainland operations to profitability,” investment banking firm B. Riley said in a report released Wednesday.

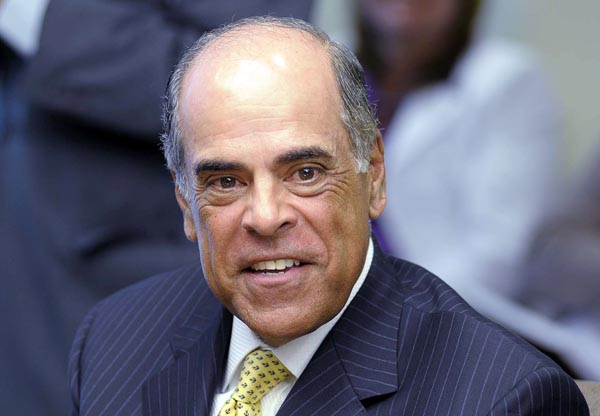

Gov. Luis Fortuño appointed former BBVA executive and banking industry veteran Rafael Blanco to head the Office of the Financial Institutions Commissioner, effective Jan. 1. Blanco will succeed current OCIF chief Alfredo Padilla, who will retire after nine years at the agency.

Three high-ranking executives — President Julio Juliá, Mark Rishell and Javier Magriná — have left Medical Card Systems Inc., the company’s board of directors announced Tuesday.

Doral Financial Corporation, the holding company of Doral Bank and Doral Bank FSB, reported a net loss of $30.2 million for the quarter ended Sept. 30, compared to a net income of $4.5 million for the prior quarter ended June 30.

Eighteen months after purchasing the failed R-G Premier Bank, Scotiabank of Puerto Rico will culminate the merger of both institutions by closing all of its 46 branches and central offices next Thursday afternoon and reopening them Monday, Nov. 14, upon completion of the integration.

Changes in federal regulations and the impact of the newly created Consumer Financial Protection Bureau on the local banking industry will be discussed for the next two days during the fifth edition of the “Minority Depository Training Seminar” co-sponsored by the Puerto Rico Bankers Association and the Federal Deposit Insurance Corporation.

Six months after the San Juan Superior Court placed National Insurance Corp. under trusteeship, employees were told Wednesday the operation has been sold to Venezuela’s Multinacional de Seguros C.A., News is my Business has learned.

Members of the island’s banking sector continue building on expanding the concept of “participatory democracy” through community reinvestment initiatives that are the focus of its 9th annual Community Reinvestment Week event that wraps up Friday.

First BanCorp President Aurelio Alemán echoed Thursday what many other banking executives have been saying in recent months: the sector is slowly starting to pick up the pieces after the storm, but much work remains ahead for it to thrive again.

Popular Inc. sailed through its third consecutive quarter on the positive side, reporting $27.5 million in net income for the three-month period ended Sept. 30. The results were fueled by the sale of its non-performing loan portfolio and investment securities available-for-sale.

First Bancorp’s recently completed $525 million capital raise will enable it to be “more aggressive” in resolving its problem loans and putting itself back on the path of profitability, research, trading and investment banking analyst firm B. Riley said Monday.

First BanCorp, parent company for FirstBank Puerto Rico announced Friday it has completed its previously announced capital raise of $525 million of common stock to institutional investors Thomas H. Lee Partners, L.P. and Oaktree Capital Management, L.P.

NIMB ON SOCIAL MEDIA