NEW YORK — Puerto Rico Gov. Alejandro García-Padilla confirmed Tuesday that his administration will have a new fiscal plan ready shortly after the federal fiscal oversight board is “appointed and operational.”

The Congressional Task Force on Economic Growth in Puerto Rico, which is responsible for identifying impediments to economic growth in the territory and recommending changes, announced Thursday it is seeking input from stakeholders.

The fate of the Puerto Rico Government Development Bank should not be liquidation, but rather a refocus to return to promoting growth on the island, Interim President Alberto Bacó said Monday, the day he took on the job of steering the former public fiscal agent.

Economic Development and Commerce Secretary Alberto Bacó will take on an additional role in Gov. Alejandro García-Padilla’s cabinet effective today, when he starts as acting President of the Government Development Bank.

The Puerto Rico Treasury Department collected some $9.1 billion in revenue for the General Fund during Fiscal 2016, exceeding Fiscal 2015 numbers by $214.4 million or 2.4 percent, agency Secretary Juan Zaragoza-Gómez said.

Puerto Rico’s Resident Commissioner in Washington, Pedro Pierluisi, said Tuesday that U.S. House Speaker Paul Ryan could name the lawmaker who will steer the work of the Puerto Rico Congressional Task Force this week.

U.S. House Democratic Leader Nancy Pelosi has appointed Puerto Rico Resident Commissioner Pedro Pierluisi to the “Congressional Task Force on Economic Growth in Puerto Rico,” which was established by the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA).

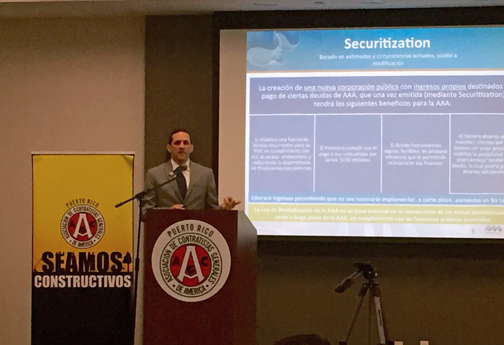

Puerto Rico Acting Gov. Víctor Suárez, signed House Bill 2864 into law Wednesday, creating the Puerto Rico Aqueduct and Sewer Authority Revitalization Act, a statute that gives the water utility the tools to access capital markets and achieve self-sustainability.

The U.S. House of Representatives approved Monday legislation authored by U.S. Rep. Nydia M. Velázquez (D-NY) to close a decades-old loophole that has caused significant financial losses for many Puerto Rican investors and retirees.

Saying she “did the best she could with the tough hand that was dealt” and ending 12 years of public service, Puerto Rico Government Development Bank President Melba Acosta is stepping down from her post, effective July 31.

Puerto Rico Aqueduct and Sewer Authority Executive Director Alberto Lázaro confirmed Thursday the agency is waiting for the governor to sign the law that will allow it to pursue external financing to begin talking to creditors next month.

The Puerto Rico Aqueduct and Sewer Authority has reached forbearance agreements with a number of federal and local government agencies to put off making payments for at least six months, according to filings submitted to the Municipal Securities Rulemaking Board on Wednesday.

Puerto Rico Government Development Bank bondholders filed a motion to ensure that they may continue to pursue their constitutional challenges to the Puerto Rico Emergency Moratorium and Financial Rehabilitation Act, Law 21 of 2016, known as the “Moratorium Act.”

The Puerto Rico Electric Power Authority announced Thursday its intention to pay all principal and interest due on July 1, 2016 under its power revenue bonds in accordance with the terms of an agreement with creditors holding approximately 70 percent of the utility’s outstanding debt, company officials said.

NIMB ON SOCIAL MEDIA